In an era where economic uncertainties and evolving fiscal policies continuously reshape the financial landscape, the importance of strategic tax planning for managing family wealth cannot be overstated. As families seek to preserve and grow their assets across generations, long-term tax strategies emerge as a crucial component of comprehensive wealth management. This article delves into the analytical underpinnings of effective tax planning, exploring methodologies that not only safeguard family wealth from erosive tax liabilities but also leverage opportunities for financial growth. With a confident approach, we examine the intricacies of estate planning, trusts, charitable giving, and investment structuring, providing a roadmap for families to navigate the complexities of the tax system and secure their financial legacies for future generations.

Maximizing Tax Efficiency Through Strategic Asset Allocation

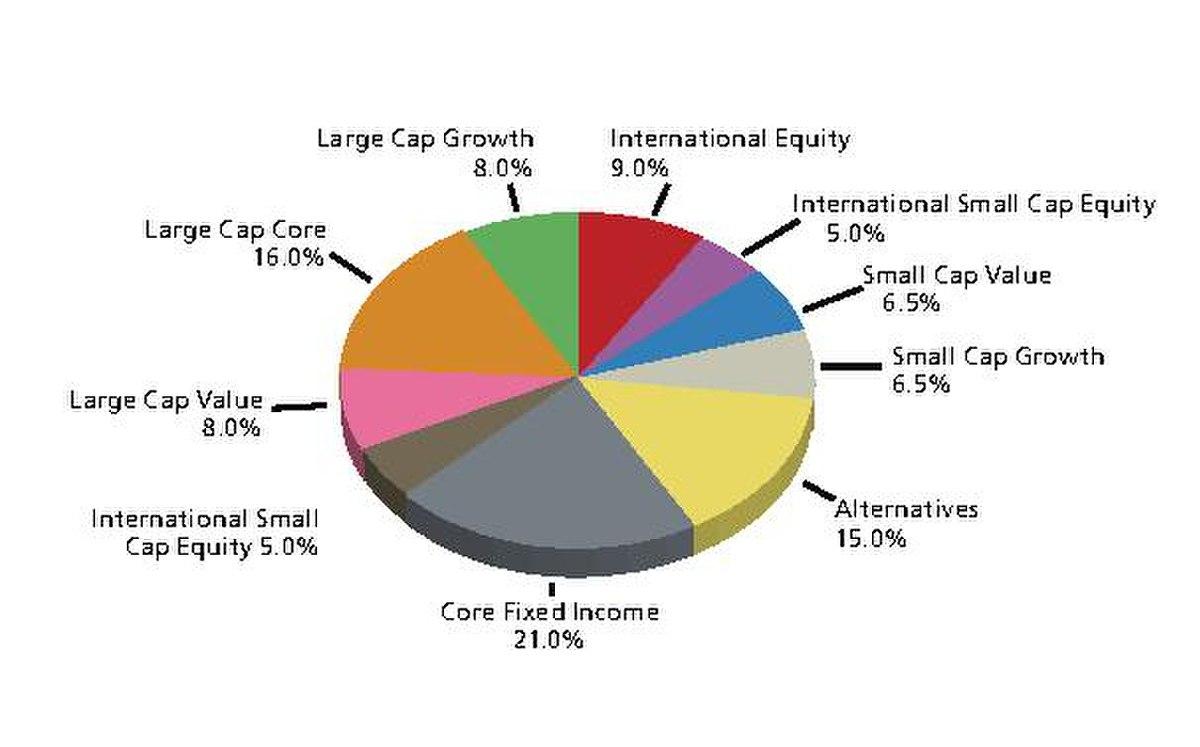

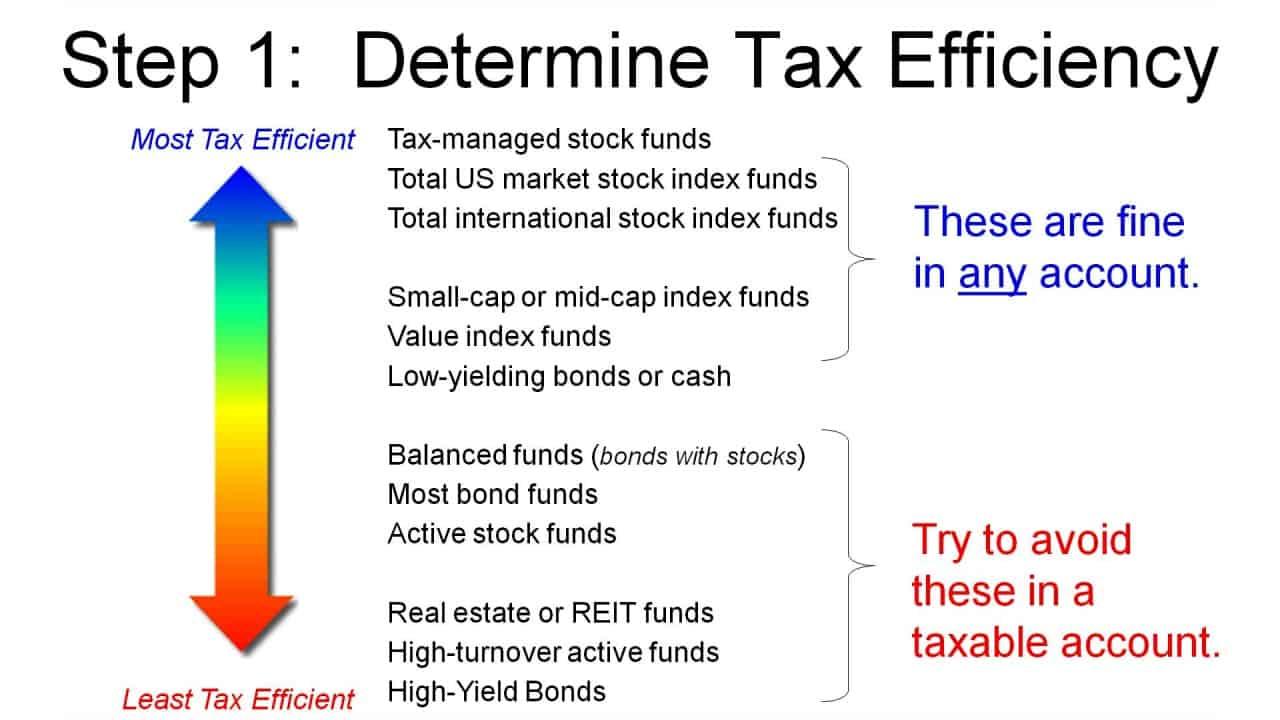

Strategic asset allocation plays a pivotal role in optimizing tax efficiency and enhancing long-term family wealth. By carefully diversifying investments across various asset classes, families can effectively manage taxable events and leverage tax-advantaged accounts. Balancing risk and return is crucial, but it is equally important to consider the tax implications of each asset class. For instance, equities held for over a year may benefit from lower capital gains tax rates, while municipal bonds offer tax-free interest income.

- Utilize Tax-Deferred Accounts: Maximize contributions to retirement accounts like IRAs and 401(k)s to defer taxes until withdrawal.

- Implement Tax-Loss Harvesting: Offset capital gains by selling securities at a loss, thereby reducing taxable income.

- Consider Asset Location: Place tax-inefficient investments in tax-deferred or tax-exempt accounts to minimize tax liability.

By aligning investment strategies with tax considerations, families can sustain and grow their wealth across generations. The key lies in ongoing evaluation and adaptation of the asset allocation strategy to respond to changing tax laws and market conditions.

Leveraging Trusts and Estates for Multigenerational Wealth Preservation

When it comes to preserving wealth across generations, trusts and estates offer robust frameworks that are both flexible and tax-efficient. Trusts can be tailored to suit various family needs, from safeguarding assets against creditors to ensuring beneficiaries receive their inheritance under favorable conditions. The strategic use of irrevocable trusts can help mitigate estate taxes by removing assets from the grantor’s taxable estate, effectively reducing the overall tax burden. In contrast, revocable trusts offer more control and can be altered as family circumstances evolve, providing a balance between accessibility and tax planning.

Incorporating trusts into your estate planning can unlock a suite of advantages:

- Asset Protection: Shield family wealth from potential legal claims and creditors.

- Tax Efficiency: Utilize tax-exempt opportunities to preserve wealth.

- Generational Control: Set specific conditions for asset distribution to future heirs.

- Charitable Giving: Leverage charitable trusts for philanthropy while enjoying tax deductions.

By implementing these strategies, families can ensure that their wealth is not only preserved but also optimized for growth and sustainability, paving the way for a financially secure legacy.

Utilizing Tax-Advantaged Accounts for Long-Term Growth

Harnessing the power of tax-advantaged accounts is a pivotal component of any robust family wealth strategy. These accounts, such as 401(k)s, IRAs, and 529 plans, offer opportunities to grow wealth while minimizing tax liabilities. By deferring taxes or benefiting from tax-free growth, families can maximize their investments over the long term. For instance, contributing to a Roth IRA allows for tax-free withdrawals during retirement, offering a strategic advantage for future financial planning. Meanwhile, utilizing a 529 plan can help cover educational expenses, with earnings growing tax-free if used for qualified education costs.

- 401(k) Plans: Contributions are tax-deductible, and growth is tax-deferred.

- Roth IRAs: Offers tax-free growth and withdrawals in retirement.

- 529 Plans: Tax-free growth for educational expenses.

Incorporating these accounts into a long-term strategy requires careful planning. Consideration of factors such as contribution limits, potential penalties for early withdrawal, and the impact of required minimum distributions (RMDs) is crucial. By aligning these tools with broader financial goals, families can effectively manage and preserve wealth across generations.

Navigating Legislative Changes to Optimize Family Wealth Management

In the ever-evolving landscape of family wealth management, staying informed about legislative changes is crucial for optimizing tax strategies. Recent reforms can have significant implications for estate planning, inheritance, and overall financial health. To navigate these changes effectively, it is essential to engage in proactive planning and consider long-term strategies that align with the latest regulations.

- Review Estate Plans Regularly: Legislative changes can affect estate tax exemptions and rates. Regular reviews ensure that your plans remain compliant and effective.

- Utilize Trusts Wisely: Trusts can offer protection and flexibility. Consider setting up or modifying trusts to take advantage of current tax benefits.

- Gifting Strategies: Take advantage of annual gift tax exclusions to transfer wealth tax-efficiently.

- Charitable Contributions: Leverage charitable giving to reduce taxable income while supporting causes important to your family.

Invest in Professional Guidance: Given the complexity of tax laws, consulting with a tax advisor or estate planner can provide personalized insights and strategies. This partnership ensures that your family’s wealth management strategy is not only compliant but also optimized for growth and preservation across generations.