In an era marked by economic uncertainty and shifting regulatory landscapes, the protection and growth of family wealth have become increasingly complex challenges for high-net-worth individuals and their advisors. Central to this evolving narrative is the role of tax havens—jurisdictions that offer favorable tax regimes and financial secrecy. As global scrutiny intensifies and tax regulations become more stringent, the strategic use of these offshore financial centers has emerged as a contentious yet potentially indispensable tool for safeguarding family assets. This article delves into the multifaceted world of tax havens, exploring their efficacy and ethical implications in the realm of family wealth protection. By examining current trends, regulatory responses, and the evolving needs of wealthy families, we aim to provide a comprehensive analysis of whether tax havens are not just a present-day solution, but indeed the future of family wealth preservation.

Exploring the Role of Tax Havens in Safeguarding Family Assets

In today’s globalized economy, tax havens have emerged as strategic tools for families aiming to preserve their wealth across generations. These jurisdictions offer more than just low tax rates; they provide a suite of financial privacy services, which can be critical in an era where economic transparency is increasingly mandated. Families leverage tax havens to not only minimize tax liabilities but also to protect their assets from political instability and economic volatility in their home countries. By utilizing trusts and offshore accounts, families can ensure that their wealth is both secure and flexible, ready to adapt to unforeseen circumstances.

Several factors make tax havens attractive for family wealth protection:

- Confidentiality: Many tax havens enforce stringent confidentiality laws, safeguarding family financial information from prying eyes.

- Legal Framework: These jurisdictions often have robust legal systems that protect against arbitrary seizure of assets.

- Investment Opportunities: Access to global investment opportunities that may not be available in one’s home country.

- Estate Planning: Tools for effective estate planning, ensuring that wealth is transferred smoothly and efficiently to future generations.

While the ethics and legality of using tax havens are often debated, their role in strategic wealth management cannot be overlooked. Families seeking to protect and grow their assets might find these jurisdictions an essential part of their financial strategy.

Understanding Legal Frameworks and Compliance in Offshore Banking

When navigating the intricate waters of offshore banking, understanding the legal frameworks and compliance standards is paramount. The global financial landscape is governed by a multitude of regulations, each with its own nuances and requirements. Tax havens, often seen as bastions of privacy and low taxation, operate under their own set of rules, which can be significantly different from domestic banking systems. Key considerations for families looking to protect their wealth offshore include:

- Regulatory Compliance: Ensuring adherence to international laws such as the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) is essential. These frameworks require transparency and reporting, which can affect privacy and tax obligations.

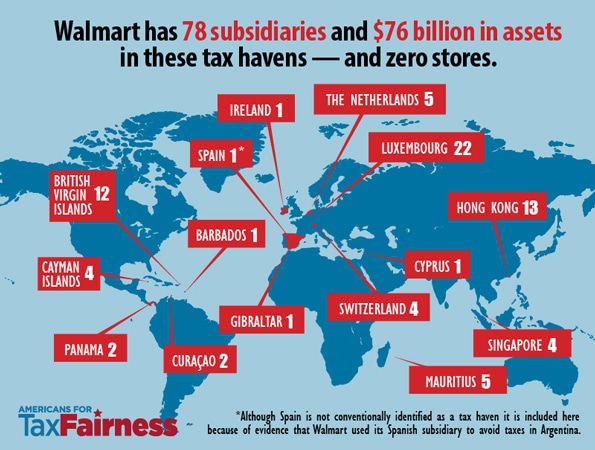

- Jurisdictional Differences: Each tax haven has its own legal structure. Understanding the specific regulations of jurisdictions like the Cayman Islands, Bermuda, or Switzerland is crucial for optimizing tax efficiency and maintaining compliance.

- Risk Management: While tax havens offer numerous benefits, they also come with potential risks, including changes in international tax laws or political shifts. Families must stay informed and adaptable to these evolving landscapes.

By comprehensively understanding these elements, families can strategically position themselves to maximize the benefits of offshore banking while minimizing potential pitfalls. The ability to navigate these complex frameworks with confidence can indeed make tax havens a viable option for future wealth protection.

Strategies for Leveraging Tax Havens in Wealth Preservation

In the complex landscape of global finance, tax havens offer sophisticated avenues for preserving family wealth. These jurisdictions, characterized by favorable tax laws and robust privacy protections, can be strategically utilized to enhance financial security. Key strategies include:

- Establishing Offshore Trusts: Offshore trusts provide a secure framework for asset protection, minimizing exposure to potential legal disputes and creditors.

- Utilizing Corporate Structures: Forming international corporations or limited liability companies in tax-friendly regions can significantly reduce tax liabilities while ensuring compliance with international laws.

- Investing in Real Estate: Acquiring property in tax havens not only diversifies investment portfolios but also offers potential tax incentives and appreciation benefits.

These strategies, when implemented with expert guidance, can transform tax havens into powerful tools for long-term wealth preservation, ensuring that family fortunes are safeguarded for generations.

Evaluating the Long-Term Viability of Tax Havens for Family Wealth

The allure of tax havens as a means to protect family wealth is often underscored by their ability to offer financial confidentiality and reduced tax liabilities. However, the long-term viability of these jurisdictions is increasingly being scrutinized. Regulatory changes and international pressure are significant factors that could reshape their future landscape. Organizations like the OECD are spearheading initiatives to increase transparency and eliminate tax avoidance strategies, making it crucial for families to stay informed about these evolving regulations.

Despite these challenges, tax havens still present opportunities for strategic financial planning. Families should consider the following factors when evaluating their options:

- Political Stability: Choosing a jurisdiction with a stable political climate ensures that wealth protection strategies remain consistent over time.

- Compliance Costs: Assess the administrative and compliance costs associated with maintaining assets in a tax haven, as these can erode potential tax savings.

- Asset Protection: Evaluate the legal frameworks in place for safeguarding assets against potential claims or liabilities.

- Reputation Risk: Consider the potential reputational impact of using tax havens, as increased scrutiny can affect public perception.

By carefully analyzing these factors, families can make informed decisions about the role of tax havens in their wealth protection strategies, ensuring both compliance and optimization of their financial portfolios.