In an era where the global landscape of wealth management is continually evolving, family offices have emerged as pivotal entities in the strategic stewardship of wealth and estate planning. As personalized financial institutions, family offices cater to the intricate needs of affluent families, offering bespoke solutions that transcend traditional wealth management paradigms. These offices serve as comprehensive platforms that integrate investment management, tax optimization, philanthropic endeavors, and legacy planning, thereby safeguarding and augmenting family wealth across generations. With their capacity to navigate the complexities of financial markets and regulatory environments, family offices have become indispensable in ensuring the continuity and growth of family wealth in an increasingly unpredictable economic climate. This article delves into the multifaceted role of family offices, examining how they effectively manage wealth and estate planning while adapting to the unique challenges and opportunities of the 21st century.

Family Offices as Strategic Architects in Wealth Management

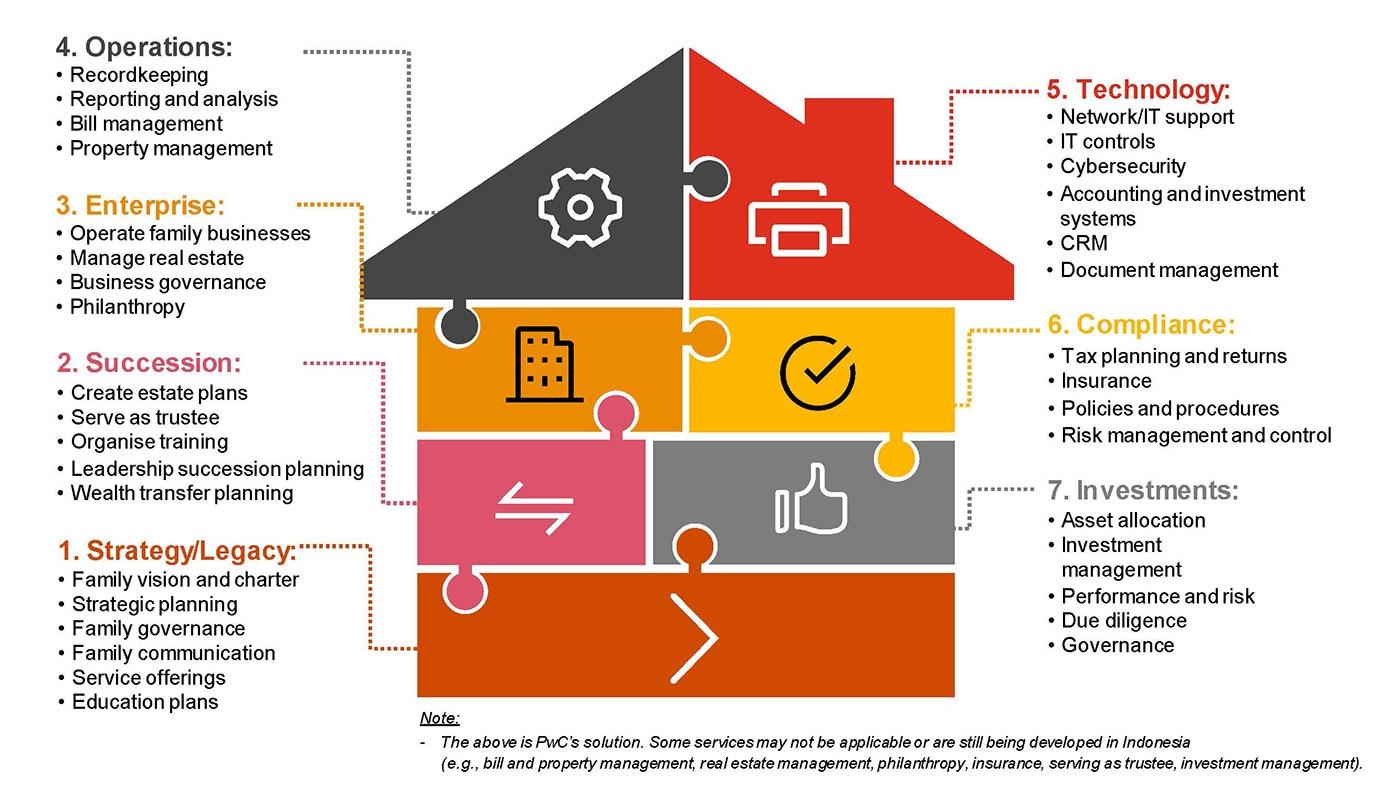

Family offices have emerged as pivotal entities in the realm of wealth management, serving as strategic architects in navigating the complex landscape of financial stewardship. These specialized entities provide a holistic approach to managing wealth, offering tailored solutions that align with the intricate needs and aspirations of affluent families. By leveraging their comprehensive understanding of both financial markets and personal dynamics, family offices craft bespoke strategies that ensure the preservation and growth of family wealth across generations.

At the heart of their approach lies a focus on customized estate planning, which is essential for safeguarding family legacies. This includes:

- Tax optimization strategies that minimize liabilities while adhering to regulatory frameworks.

- Succession planning that ensures a seamless transition of leadership and assets to future generations.

- Philanthropic initiatives that align with family values and enhance societal impact.

Through these meticulously crafted strategies, family offices not only manage wealth but also transform it into a powerful tool for long-term success and legacy building.

Navigating Estate Planning Complexities with Family Offices

In the intricate landscape of estate planning, family offices play a pivotal role in streamlining processes and providing bespoke solutions tailored to individual family needs. These entities serve as comprehensive coordinators, merging legal, financial, and administrative expertise to craft strategies that preserve and enhance wealth across generations. With a keen understanding of tax implications, asset distribution, and succession planning, family offices help families navigate the labyrinthine world of estate laws and regulations, ensuring a seamless transition of assets.

- Personalized Strategies: Family offices offer customized estate plans that reflect the unique values and goals of each family, from philanthropic pursuits to business succession.

- Integrated Services: By uniting various professionals under one roof, family offices ensure that legal, tax, and investment advice is harmoniously aligned.

- Risk Management: Proactive risk assessment and mitigation strategies protect family wealth from unforeseen challenges.

- Confidentiality and Trust: Ensuring privacy and fostering trust, family offices act as discreet stewards of family legacies.

By leveraging the multifaceted capabilities of family offices, families can confidently navigate the complexities of estate planning, safeguarding their wealth while upholding their legacy and values.

Leveraging Family Office Expertise for Multigenerational Wealth Preservation

Family offices serve as pivotal stewards of wealth, guiding families through the complexities of financial management and estate planning with a tailored approach. By providing comprehensive services that extend beyond traditional financial advice, these entities help families navigate the intricacies of tax optimization, risk management, and philanthropic endeavors. Key benefits of utilizing family office expertise include:

- Customized Wealth Management: Crafting bespoke investment strategies that align with the family’s values and long-term objectives.

- Intergenerational Education: Offering financial literacy programs to younger generations to ensure they are well-prepared to inherit and manage family wealth.

- Estate Planning: Developing robust plans that protect family assets and ensure seamless transitions across generations, minimizing legal disputes and tax liabilities.

These elements underscore the essential role family offices play in preserving wealth across generations, acting as the backbone of strategic financial stewardship and ensuring the family’s legacy endures.

Implementing Tailored Investment Strategies through Family Offices

Family offices are uniquely positioned to develop and implement investment strategies that are meticulously tailored to the specific needs and aspirations of affluent families. These specialized entities leverage a holistic understanding of a family’s financial landscape, ensuring that investment decisions are not only financially sound but also align with the family’s long-term goals and values. Customized investment portfolios crafted by family offices are often designed to accommodate diverse asset classes, risk tolerances, and time horizons, providing a bespoke financial solution that is rarely achievable through standard wealth management services.

- Personalized Asset Allocation: Family offices prioritize a deep dive into the family’s financial and personal circumstances, enabling them to allocate assets in a manner that is both strategic and personalized.

- Intergenerational Wealth Transfer: By understanding family dynamics and legacy aspirations, family offices craft strategies that facilitate seamless and tax-efficient wealth transfer across generations.

- Philanthropic Goals Integration: Family offices can integrate philanthropic objectives into the investment strategy, aligning the family’s charitable endeavors with their overall financial goals.

Through these tailored strategies, family offices not only manage wealth but also enhance the family’s financial legacy, ensuring that their investment approach is as unique as the families they serve.