In an era where financial landscapes are becoming increasingly complex and globalized, the management of multi-generational wealth demands a strategic approach that extends beyond traditional investment practices. Establishing a family office has emerged as a sophisticated solution for families seeking to preserve and grow their wealth across generations. This article delves into the intricacies of setting up a family office, offering a comprehensive guide to navigating the myriad challenges and opportunities inherent in managing substantial assets. With a focus on creating a tailored structure that aligns with familial values and long-term objectives, we explore key considerations such as governance, risk management, and the integration of cutting-edge technology. By examining the critical steps and best practices involved, this analysis aims to equip affluent families with the knowledge and confidence needed to establish a robust family office capable of safeguarding their legacy for the future.

Understanding the Core Functions and Benefits of a Family Office

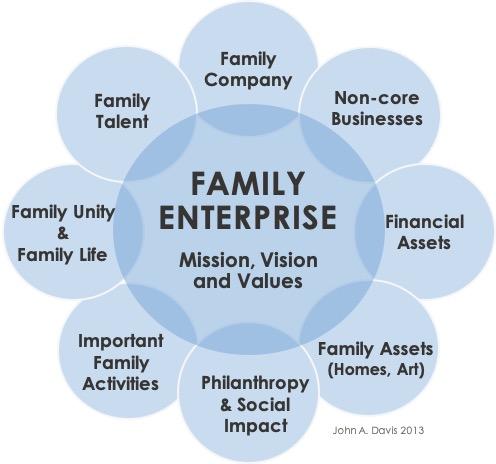

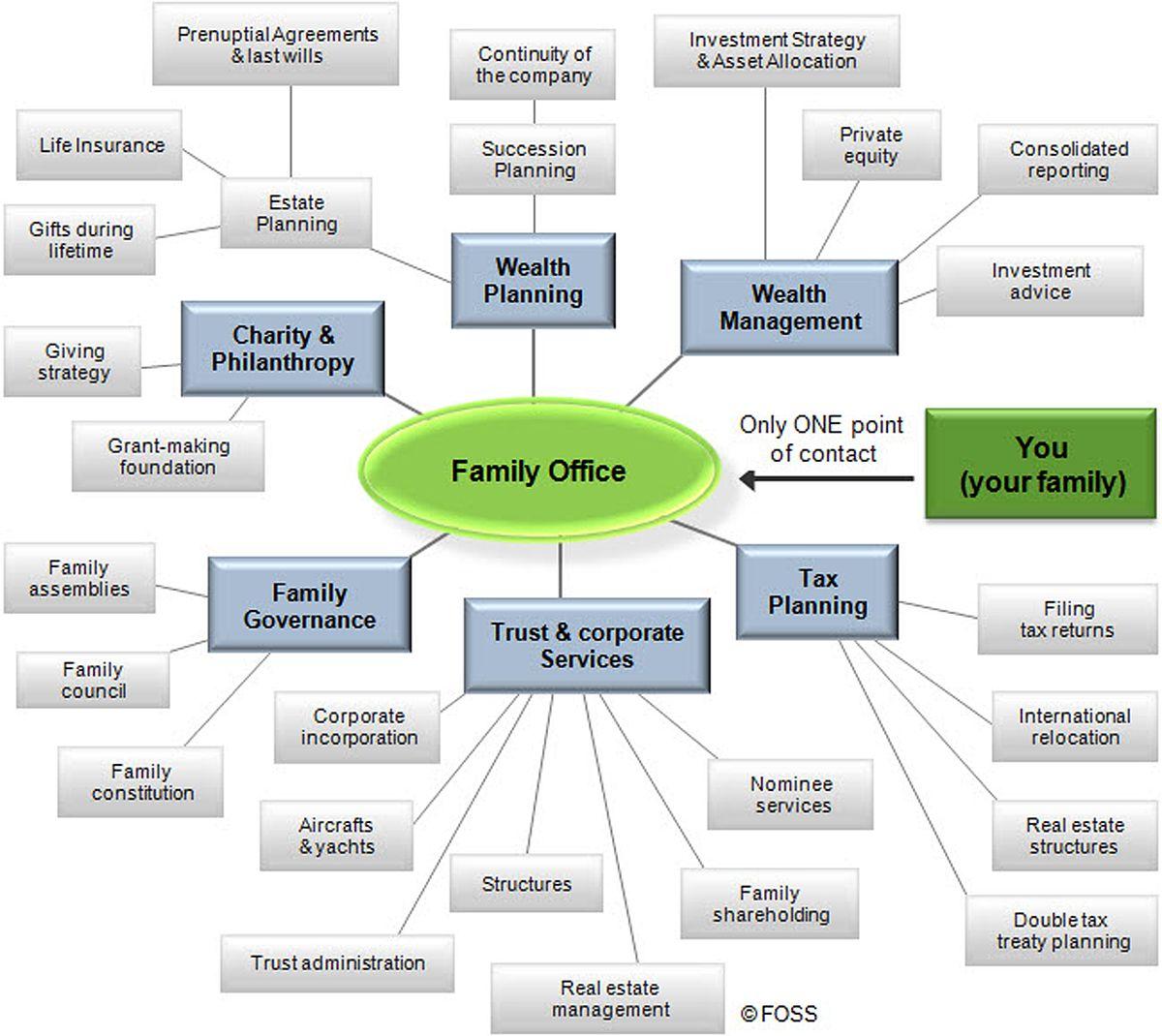

A family office serves as a centralized management structure for the financial and personal affairs of affluent families, primarily aiming to preserve and grow wealth across generations. The core functions of a family office encompass a wide range of services, including:

- Investment Management: Crafting personalized investment strategies that align with the family’s financial goals and risk tolerance.

- Wealth Planning: Designing comprehensive estate and tax planning solutions to ensure efficient wealth transfer and tax minimization.

- Administrative Services: Handling everyday financial tasks, such as bill payments, bookkeeping, and financial reporting, allowing family members to focus on their passions and ventures.

- Philanthropy Coordination: Assisting in the establishment and management of charitable foundations and donations, aligning with the family’s values and legacy aspirations.

Beyond these functions, the benefits of a family office are substantial. By providing a tailored and holistic approach to wealth management, family offices offer families the peace of mind that their financial affairs are handled with expertise and discretion. Furthermore, with a dedicated team of professionals, families can achieve a more cohesive and strategic approach to managing their assets, ensuring that their wealth not only endures but flourishes through the generations.

Strategies for Structuring and Staffing Your Family Office

When structuring a family office, it’s essential to tailor the organizational framework to the specific needs and goals of your family. Flexibility and scalability should be the core principles guiding your decisions. Consider creating a dynamic structure that can adapt to evolving family circumstances and market conditions. Key elements include establishing clear governance protocols, defining roles and responsibilities, and ensuring robust communication channels. Additionally, implement a strategic plan that aligns with the family’s long-term vision and values.

Staffing your family office requires a meticulous approach to ensure the right mix of skills and expertise. Consider the following strategies:

- Hire specialized professionals who bring expertise in areas such as investment management, tax planning, and estate law.

- Leverage technology to streamline operations and enhance decision-making processes.

- Foster a culture of collaboration and continuous learning to keep the team agile and responsive to changes.

- Engage trusted external advisors to provide independent perspectives and fill any gaps in internal expertise.

By focusing on these strategies, your family office can effectively manage and preserve wealth across generations.

Implementing Robust Governance and Decision-Making Frameworks

Establishing a family office to manage multi-generational wealth requires a meticulously designed governance and decision-making framework. This ensures that the values, priorities, and financial goals of the family are consistently maintained and executed over time. A robust governance structure not only facilitates effective decision-making but also helps in managing potential conflicts, fostering transparency, and ensuring accountability among stakeholders. Key elements to consider include:

- Family Constitution: Drafting a comprehensive document that outlines the family’s vision, mission, and values can serve as a guiding compass for all financial and non-financial decisions.

- Advisory Board: Establishing a board composed of family members and external experts can provide diverse perspectives and strategic guidance.

- Decision-Making Processes: Clearly defined procedures for making investment and operational decisions help in maintaining objectivity and efficiency.

- Succession Planning: A detailed plan for transitioning leadership roles is crucial to ensure continuity and preserve the family legacy.

Implementing these elements creates a resilient governance framework that adapts to changing circumstances while safeguarding the family’s wealth and values for future generations.

Leveraging Technology and Data for Efficient Wealth Management

In today’s rapidly evolving financial landscape, the integration of technology and data analytics is pivotal for crafting a robust strategy for managing multi-generational wealth. Family offices can significantly benefit from leveraging cutting-edge tools and data-driven insights to streamline their operations and enhance decision-making processes. By harnessing the power of financial technologies, family offices can efficiently monitor and manage diverse asset portfolios, ensuring transparency and agility in responding to market changes.

- Data Analytics: Utilize advanced analytics to identify trends and opportunities, enabling informed investment decisions.

- Automation Tools: Implement automated solutions for routine tasks such as tax filing, reporting, and compliance to reduce errors and save time.

- Risk Management Systems: Employ sophisticated risk assessment technologies to protect wealth from potential market volatilities.

- Secure Communication Platforms: Ensure confidentiality and seamless communication among stakeholders with encrypted communication tools.

By embedding these technologies into the core operations, family offices can transform data into actionable intelligence, thus safeguarding and growing wealth across generations. The strategic use of technology not only enhances operational efficiency but also provides a competitive edge in navigating the complexities of modern wealth management.