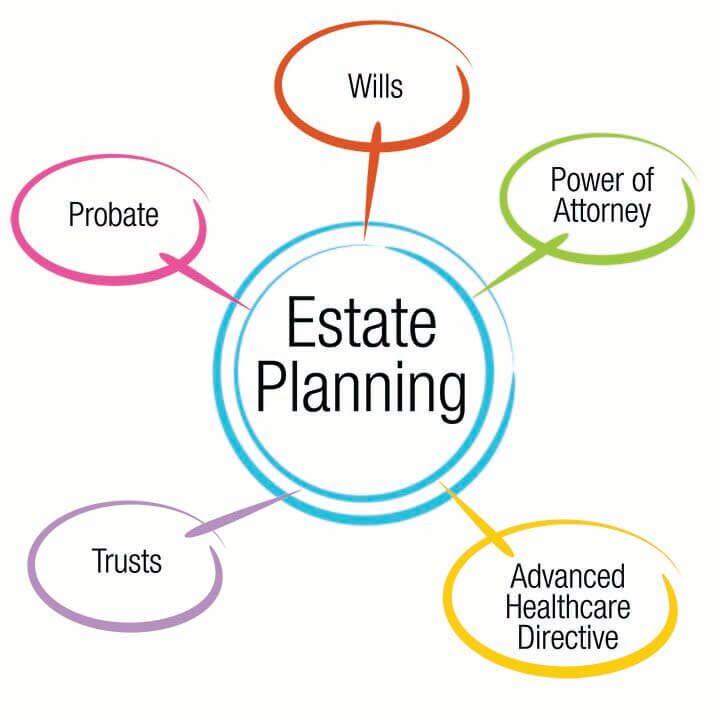

In an era where personal values and family dynamics are more diverse than ever, crafting an estate plan that truly reflects your family’s vision is both a critical and empowering endeavor. Estate planning is no longer a one-size-fits-all process; it demands a tailored approach that aligns with the unique aspirations, beliefs, and circumstances of each family. By delving into the intricacies of modern estate planning, this article aims to provide a comprehensive guide to creating a strategy that not only safeguards your assets but also encapsulates your family’s ethos and long-term goals. With a confident understanding of the legal, financial, and emotional components involved, you can ensure that your estate plan serves as a lasting testament to your family’s vision, offering clarity and peace of mind for generations to come.

Understanding Your Familys Unique Needs and Goals

Every family is a tapestry of diverse aspirations, values, and needs, making it crucial to tailor your estate plan to reflect this uniqueness. Begin by identifying what truly matters to your family—whether it’s preserving a cherished summer home, ensuring the financial security of future generations, or supporting philanthropic endeavors. By understanding these priorities, you can create a plan that is not only practical but deeply personal.

- Assess individual needs: Consider the specific financial and personal circumstances of each family member.

- Define long-term goals: Align your estate planning with your family’s vision for the future, such as education funding or retirement plans.

- Incorporate family values: Reflect your core values in your plan, whether they involve sustainability, education, or cultural preservation.

By taking these steps, you ensure that your estate plan is a living document, capable of evolving alongside your family’s changing dynamics and goals. Remember, a well-crafted plan is not just about wealth distribution; it’s about securing a legacy that honors the essence of your family.

Crafting a Comprehensive Will and Trust Structure

Building a robust will and trust structure is an essential aspect of an effective estate plan. It begins with understanding the unique needs and aspirations of your family, ensuring that your legacy is both preserved and aligned with your collective vision. A well-crafted will not only delineates the distribution of assets but also addresses crucial elements like guardianship for minor children and specific bequests to loved ones or charitable organizations. Meanwhile, a trust offers additional benefits such as privacy, probate avoidance, and tailored distribution schedules, which can be particularly advantageous for families with complex financial landscapes or specific goals.

To achieve a harmonious estate plan, consider the following key elements:

- Clarity and Specificity: Clearly outline asset distribution to avoid potential disputes.

- Flexibility: Design trusts that can adapt to changing circumstances or family dynamics.

- Professional Guidance: Engage with legal and financial experts to navigate complex regulations and tax implications.

- Regular Reviews: Periodically reassess and update your estate plan to reflect changes in family, assets, or laws.

These strategies ensure that your estate plan not only secures your assets but also honors the values and future aspirations of your family.

Incorporating Tax Efficiency into Your Estate Plan

When crafting an estate plan, considering tax efficiency is crucial to preserving the wealth you intend to pass on. An effective strategy involves utilizing a combination of legal tools and financial instruments that can help minimize tax liabilities. Trusts are a popular option, as they can be designed to reduce estate and gift taxes. By setting up an irrevocable trust, you can transfer assets out of your estate, thus potentially lowering the taxable value of your estate. Moreover, gifting strategies allow you to take advantage of the annual gift tax exclusion, which enables you to transfer a certain amount each year to beneficiaries without incurring taxes.

- Charitable giving: Donating to charities not only supports causes you care about but can also provide significant tax deductions.

- Family Limited Partnerships (FLPs): These can help manage family-owned businesses or properties, offering both tax benefits and asset protection.

- Life insurance: Properly structured, it can provide liquidity to cover estate taxes and other expenses, ensuring that your heirs are not burdened with unexpected costs.

Integrating these elements into your estate plan requires a thorough understanding of current tax laws and future implications. By doing so, you ensure that your estate plan aligns with your family’s long-term vision while effectively managing tax burdens.

Ensuring Long-term Flexibility and Adaptability

In the ever-evolving landscape of family dynamics and financial landscapes, it’s crucial to design an estate plan that is both resilient and adaptable. This requires a strategic approach that anticipates changes and accommodates unforeseen circumstances. Flexibility in estate planning means not only considering your current assets and family structure but also envisioning how these might evolve over time. Here are some key strategies to ensure your estate plan remains relevant:

- Regular Reviews: Set a schedule to review your estate plan every 3 to 5 years, or sooner if major life events occur, such as births, deaths, marriages, or divorces.

- Dynamic Trusts: Consider implementing trusts that allow for modifications. These can provide the adaptability needed to address changes in tax laws or family circumstances.

- Incorporate Powers of Attorney: Ensure you have durable powers of attorney for both financial and healthcare decisions, allowing trusted individuals to act on your behalf if necessary.

- Beneficiary Designations: Keep beneficiary designations up to date on retirement accounts, insurance policies, and other assets to reflect your current wishes.

By embedding these elements into your estate plan, you create a robust framework that can withstand life’s uncertainties, ensuring your family’s vision is honored through time. With these proactive measures, your estate plan will not only reflect your current values but also adapt to future shifts, safeguarding your legacy for generations to come.