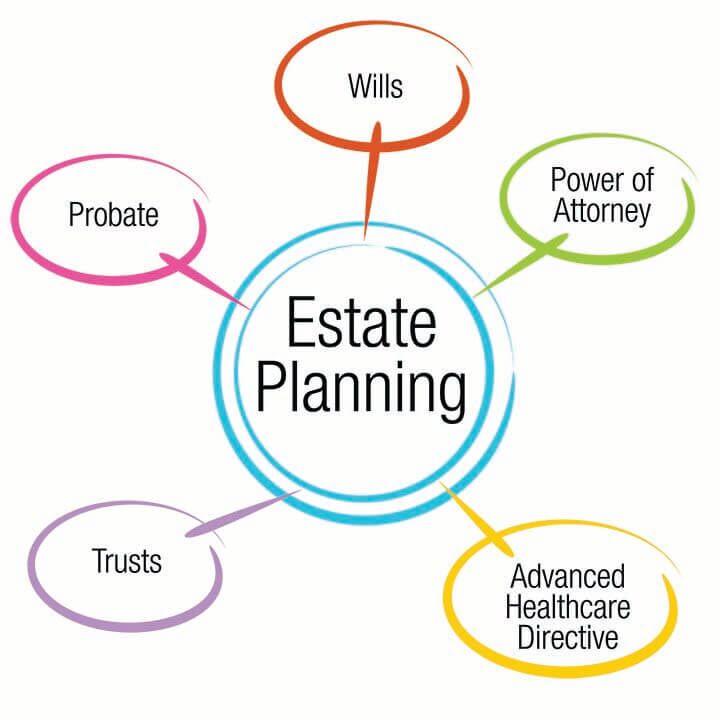

In an era where financial landscapes are constantly evolving, creating an estate plan that aligns with your family values is more crucial than ever. An estate plan is not merely a collection of legal documents; it is a comprehensive strategy that encapsulates your personal beliefs, priorities, and aspirations for future generations. By integrating your family values into this plan, you ensure that your legacy extends beyond material wealth, fostering a continuum of principles and ethics that define your lineage. This article delves into the analytical process of crafting an estate plan that not only secures your assets but also perpetuates the values that your family holds dear. With a confident approach, we will explore key considerations and strategies to transform your estate plan into a reflection of your unique family ethos, ensuring that your legacy is preserved with integrity and intention.

Understanding the Core Values of Your Family

Identifying and understanding the core values that guide your family is crucial when crafting an estate plan that truly resonates with your loved ones. These values are the principles and beliefs that shape your family’s identity and influence your decisions. Consider reflecting on what is most important to your family. Is it financial security, educational opportunities, or perhaps philanthropy? Recognizing these priorities helps ensure that your estate plan not only protects your assets but also aligns with the legacy you wish to leave behind.

- Communication: Open dialogues about what matters most can reveal shared values and aspirations.

- Traditions: Consider how family traditions and rituals can be maintained or supported through your estate plan.

- Future Generations: Think about how your plan can provide for and empower future generations, instilling the values you cherish.

By weaving these core values into the fabric of your estate plan, you create a document that not only distributes wealth but also preserves the essence of your family’s beliefs and dreams.

Aligning Estate Planning with Ethical and Cultural Beliefs

When crafting an estate plan that resonates with your family’s ethical and cultural values, it’s crucial to integrate both traditional and contemporary elements. Start by engaging in conversations with family members to identify core beliefs and values that should be preserved. These might include cultural rituals, ethical stances on wealth distribution, or preferences for charitable giving. Understanding these values can guide the selection of executors, trustees, and beneficiaries, ensuring they are aligned with the family’s ethical compass.

Consider incorporating the following elements to ensure your estate plan mirrors your values:

- Cultural Considerations: Address cultural traditions or religious practices that should be honored in the distribution of assets.

- Ethical Investments: Choose investment vehicles that align with your ethical beliefs, such as socially responsible funds.

- Philanthropic Goals: Establish charitable trusts or foundations to support causes that reflect your family’s principles.

- Personal Stories: Include personal letters or video messages to convey the importance of these values to future generations.

By thoughtfully integrating these elements, your estate plan can serve not just as a financial roadmap, but as a legacy that upholds and perpetuates your family’s unique cultural and ethical identity.

Incorporating Charitable Giving into Your Estate Plan

Infusing your estate plan with charitable giving can be a profound way to echo your family’s values beyond your lifetime. Begin by identifying causes that resonate deeply with your family ethos. Consider organizations that align with your moral compass and have a proven track record of impactful work. Be strategic in your approach to maximize the benefits both for the charity and your estate. One way to do this is by integrating charitable trusts, which can offer potential tax advantages while ensuring a steady income stream for beneficiaries.

Explore different options such as:

- Bequests in your will, ensuring specific assets or sums are directed to your chosen charities.

- Charitable remainder trusts, which provide income to your beneficiaries for a period before the remainder goes to the charity.

- Donor-advised funds, allowing you to recommend grants to charities over time while benefiting from an immediate tax deduction.

By thoughtfully incorporating these elements, your estate plan not only serves your family’s financial needs but also acts as a testament to the causes you hold dear, ensuring your legacy supports your community’s betterment.

Ensuring Multigenerational Wealth Preservation

Creating an estate plan that genuinely reflects your family values is essential for maintaining harmony and ensuring that your wealth is preserved across generations. Start by engaging in open dialogues with family members to understand their aspirations and values. This not only fosters a collective vision but also helps in crafting a plan that respects diverse perspectives. Incorporate family governance structures that include regular meetings and decision-making processes, which can be crucial for long-term wealth management and conflict resolution.

Consider implementing strategies that align with your values, such as establishing charitable trusts if philanthropy is a priority, or creating education funds to support lifelong learning within the family. Key elements to focus on include:

- Succession Planning: Clearly define roles and responsibilities for future generations to prevent power struggles.

- Tax Efficiency: Leverage trusts and other vehicles to minimize tax liabilities, ensuring more wealth is retained.

- Asset Protection: Safeguard your assets against potential creditors and lawsuits by setting up the appropriate legal structures.

By embedding these strategies into your estate plan, you not only safeguard your wealth but also perpetuate a legacy that truly embodies your family’s core values.