In the intricate landscape of personal finance, the concept of compound interest stands as a powerful catalyst for wealth accumulation, often underestimated yet profoundly impactful. As families navigate the complexities of saving and investing, understanding the mechanics of compound interest becomes crucial in crafting a sustainable financial future. This analytical exploration delves into the transformative potential of compound interest, unraveling how it can exponentially grow your family’s wealth over time. With a confident tone, this article aims to illuminate the strategies and insights necessary to harness this financial phenomenon, empowering families to make informed decisions that will secure and enhance their economic well-being for generations to come.

Understanding the Mechanics of Compound Interest

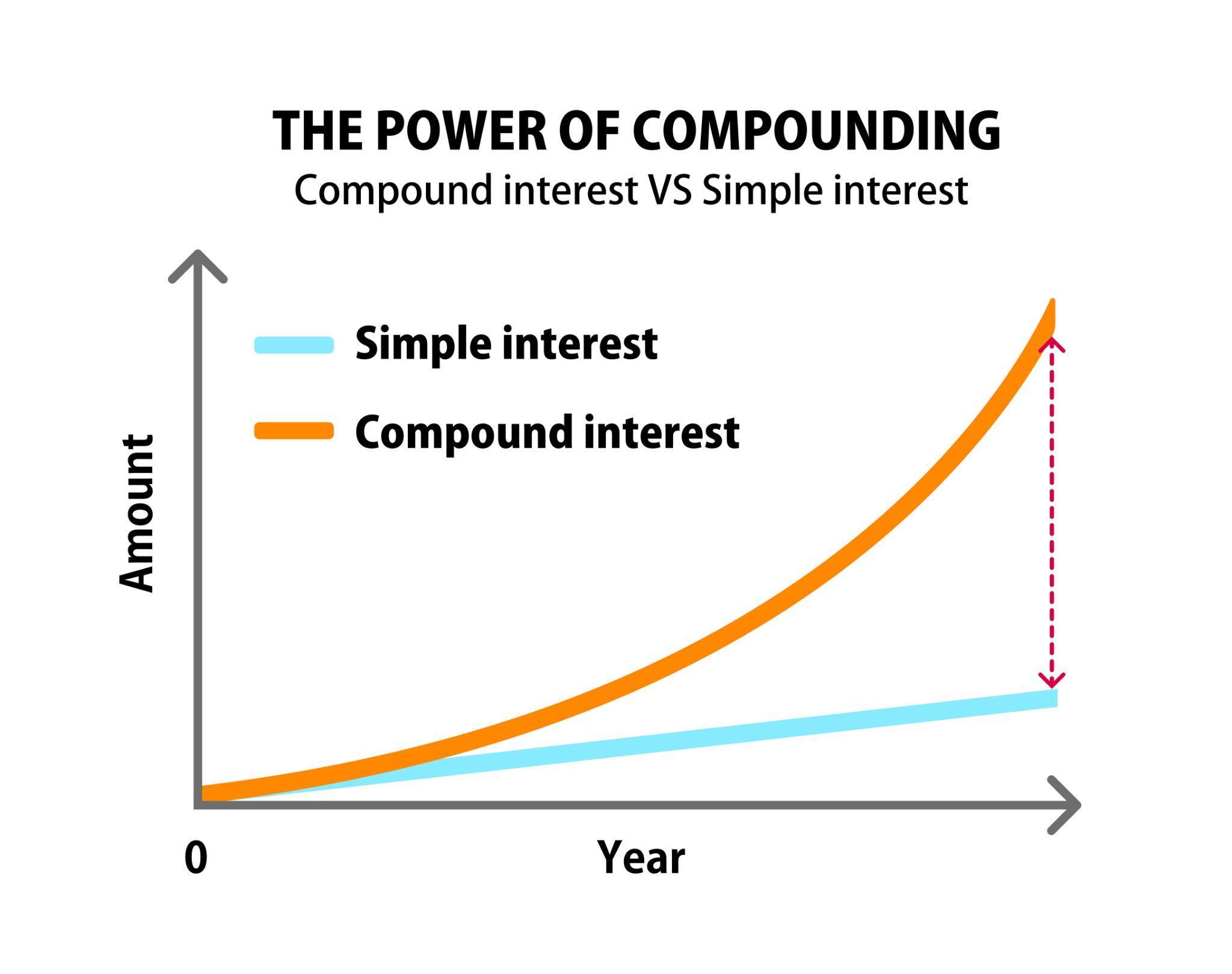

Compound interest is a financial phenomenon that can significantly accelerate the growth of your family’s wealth by generating returns not only on your initial investment but also on the accumulated interest over time. This “interest on interest” effect can transform modest savings into substantial sums, provided that the interest is allowed to compound over a long period. Here’s how it works:

- Principal Amount: The original sum of money invested or loaned.

- Interest Rate: The percentage at which your money grows per compounding period.

- Compounding Frequency: How often the interest is applied to the balance. The more frequent the compounding, the more interest accumulates.

- Time: The duration for which your money is invested. The power of compound interest truly reveals itself over longer periods.

By leveraging compound interest, families can create a robust financial foundation. Patience and consistency are key; small, regular contributions can grow into a substantial nest egg, securing a prosperous future for generations. Understanding these mechanics enables strategic financial planning, making compound interest a formidable ally in wealth creation.

Strategies to Maximize Your Familys Investment Returns

One of the most effective ways to enhance your family’s investment returns is by leveraging the magic of compound interest. This strategy revolves around the concept of earning returns not just on your initial investment but also on the accumulated interest over time. To harness this powerful financial tool, consider the following approaches:

- Start Early: The sooner you begin investing, the more time compound interest has to work in your favor. Even small, consistent contributions can grow significantly over the years.

- Reinvest Dividends: Instead of cashing out dividends from stocks or mutual funds, reinvest them to purchase additional shares. This accelerates the compounding effect and boosts your portfolio’s growth.

- Diversify Wisely: While it’s tempting to chase high returns with risky investments, balancing your portfolio with a mix of asset classes can protect against volatility and ensure steady compounding over time.

- Regular Contributions: Make it a habit to add to your investments regularly. Whether it’s monthly or quarterly, consistent contributions amplify the impact of compounding.

By strategically applying these tactics, your family can effectively maximize investment returns and steadily build wealth over time.

Choosing the Right Accounts for Compound Growth

When aiming to harness the full potential of compound interest for your family’s financial future, selecting the appropriate accounts is paramount. Not all accounts are created equal when it comes to compounding capabilities. Consider these key options:

- High-Yield Savings Accounts: Offering higher interest rates than traditional savings accounts, these are a great starting point for families wanting to keep their funds liquid while still benefiting from compound growth.

- Certificates of Deposit (CDs): With fixed interest rates and maturity dates, CDs can offer predictable growth. The longer the term, the higher the interest rate, providing an opportunity for substantial compounding.

- Individual Retirement Accounts (IRAs): IRAs not only provide tax advantages but also allow investments in a variety of assets, which can lead to significant compounding over the years.

- 529 College Savings Plans: Designed for education expenses, these accounts grow tax-free, making them an ideal choice for parents focused on long-term educational savings.

Understanding the nuances of these accounts and aligning them with your family’s financial goals will ensure that you are maximizing the benefits of compound interest. Choose wisely, and watch your wealth grow exponentially.

Common Mistakes and How to Avoid Them

- Underestimating the Impact of Time: One of the most common pitfalls is starting too late. The magic of compound interest lies in its ability to grow exponentially over time. Delaying investment, even by a few years, can significantly reduce potential gains. To sidestep this mistake, encourage your family to start investing as early as possible, even if it’s a small amount. Early investments allow compound interest to work its wonders, multiplying your wealth over decades.

- Neglecting Regular Contributions: Many assume that a one-time investment will suffice. However, consistent contributions are crucial in maximizing the benefits of compounding. Avoid the trap of complacency by setting up automatic monthly contributions to your investment accounts. This disciplined approach ensures steady growth and can buffer against market volatility.

- Ignoring Fees and Inflation: Overlooking the impact of fees and inflation can erode your returns. Always be mindful of investment fees, which can eat into your profits over time. Opt for low-cost index funds or ETFs to minimize this effect. Additionally, consider inflation when calculating your real returns. Investing in assets that historically outpace inflation, like stocks, can help preserve your family’s purchasing power.