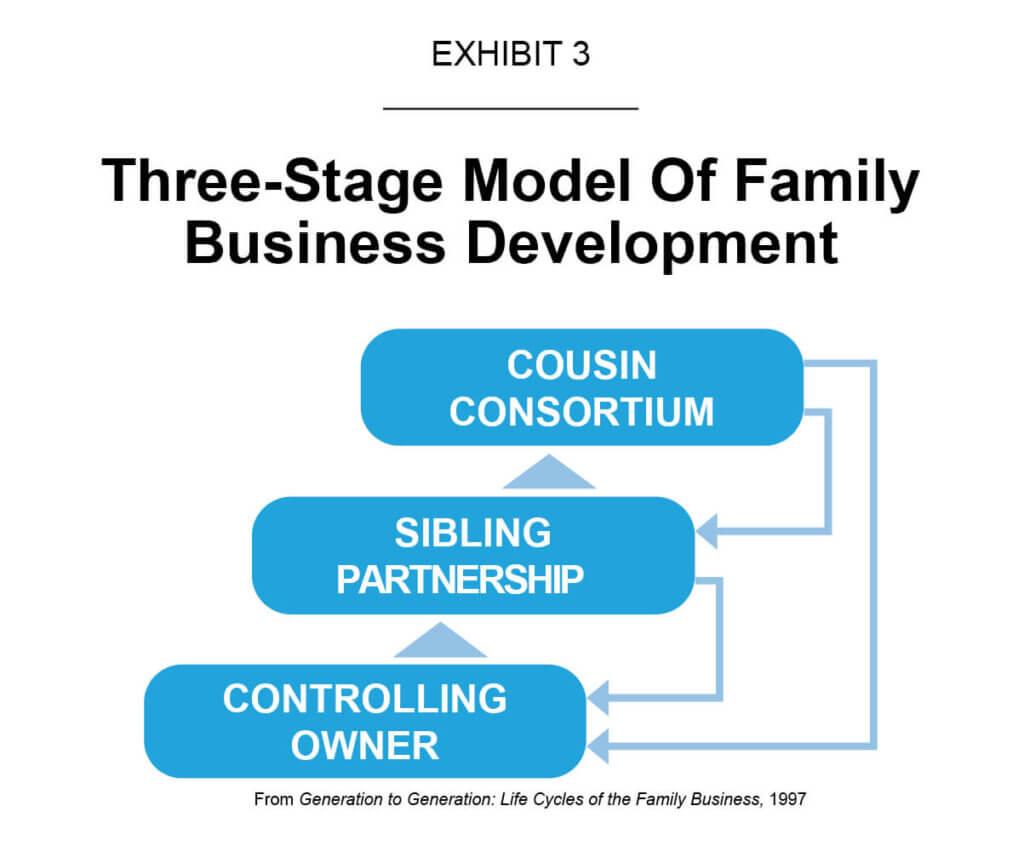

In the intricate tapestry of the global economy, family-owned businesses serve as both foundational threads and dynamic catalysts for innovation and growth. Yet, these enterprises face a unique set of challenges that often threaten their longevity and stability, with succession planning emerging as a particularly critical hurdle. As the baton of leadership must inevitably pass from one generation to the next, the absence of a well-structured succession plan can lead to disruptions that jeopardize not only business continuity but also family harmony. This article delves into the nuanced landscape of succession planning for family-owned businesses, exploring the strategic frameworks and considerations essential for ensuring a seamless transition of leadership. By examining both the potential pitfalls and best practices, we aim to equip family business stakeholders with the insights needed to safeguard their legacy while fostering sustained growth and innovation.

Identifying Key Roles and Talent in Family Enterprises

Within the intricate dynamics of family enterprises, identifying and nurturing key roles and talent is crucial for successful succession planning. The unique structure of these businesses often intertwines personal relationships with professional responsibilities, making it imperative to evaluate potential successors not just on merit but also on their understanding of the family values and business ethos. Strategic talent identification involves recognizing individuals who exhibit leadership potential, possess a comprehensive understanding of the industry, and demonstrate the ability to innovate while respecting the business’s heritage.

Key roles in family businesses often include, but are not limited to:

- Visionary Leaders: Those who can articulate and drive the long-term vision of the company.

- Operational Managers: Individuals adept at managing day-to-day operations with efficiency.

- Financial Stewards: Those responsible for maintaining financial health and sustainability.

- Family Liaisons: Members who maintain harmony between family interests and business goals.

In cultivating these roles, it is essential to implement structured development programs and mentorship opportunities that align with both business objectives and familial aspirations. By doing so, family enterprises can ensure a seamless transition of leadership, safeguarding their legacy for future generations.

Navigating Interpersonal Dynamics and Conflicts

Family businesses often thrive on deep-rooted relationships, but these connections can also give rise to complex interpersonal dynamics, especially when planning for succession. Understanding and addressing these dynamics is crucial to ensuring a smooth transition. At the heart of many conflicts are issues of identity, legacy, and the emotional ties that bind family members to the business. It is essential to foster an environment where open communication is encouraged, allowing each member to express their concerns and aspirations without fear of judgment.

To successfully navigate these challenges, consider implementing strategies such as:

- Facilitated discussions: Engage a neutral third party to mediate conversations, ensuring all voices are heard.

- Defined roles and responsibilities: Clearly outline each family member’s role in the business to avoid overlaps and misunderstandings.

- Regular family meetings: Schedule consistent meetings to discuss business matters, keeping everyone aligned and informed.

By proactively addressing these potential areas of conflict, family businesses can not only preserve harmony but also strengthen their foundation for future growth and success.

Legal and Financial Considerations for a Smooth Transition

Ensuring a seamless transition in family-owned businesses involves careful attention to both legal and financial frameworks. It’s crucial to establish a comprehensive succession plan that addresses potential legal challenges and financial implications. Legal considerations might include drafting or updating wills, trusts, and shareholder agreements to reflect the intended succession path. It’s also wise to consult with legal experts to navigate potential liabilities and compliance issues that may arise during the transition. In some cases, revisiting business structures, such as converting a family-owned business into a corporation, can offer added legal protection and operational flexibility.

On the financial side, securing the business’s future often involves strategic tax planning and valuation assessments. Key financial considerations should include:

- Valuation: Conducting a thorough valuation to ensure fair distribution of assets among family members.

- Tax Strategies: Implementing tax-efficient strategies to minimize liabilities and preserve wealth across generations.

- Funding Mechanisms: Exploring options like life insurance policies or buy-sell agreements to provide liquidity for future transitions.

By proactively addressing these elements, family-owned businesses can pave the way for a transition that not only preserves their legacy but also ensures continued growth and stability.

Developing a Robust Succession Strategy with Clear Timelines

A well-structured succession strategy is pivotal for the longevity and stability of family-owned businesses. By establishing clear timelines, business owners can ensure a seamless transition of leadership that mitigates risks and maintains operational continuity. Start by identifying potential successors early on, assessing their readiness, and providing them with the necessary training and mentorship. This proactive approach not only builds their competence but also their confidence in taking over key roles.

Implementing structured timelines in your succession plan helps in managing expectations and maintaining transparency. Consider the following elements to strengthen your strategy:

- Short-term Goals: Outline immediate actions and skills development for potential successors.

- Medium-term Milestones: Define benchmarks for evaluating progress and readiness for larger responsibilities.

- Long-term Vision: Align the successor’s growth with the overarching business objectives and future expansion plans.

By integrating these timelines, you can ensure a balanced and efficient transfer of leadership that upholds the business’s core values and strategic goals.