In an era marked by increasing economic disparity and shifting societal norms, the question of how to distribute one’s wealth upon death has become more complex and contentious than ever before. The traditional practice of leaving one’s estate exclusively to offspring is being scrutinized through various lenses, including ethical considerations, societal impact, and familial obligations. This article delves into the multifaceted debate surrounding the inheritance of wealth, examining whether it is justifiable or potentially detrimental to allocate one’s entire fortune solely to one’s children. By exploring diverse perspectives, including those of financial experts, ethicists, and social commentators, we aim to provide a comprehensive analysis of the implications of this age-old practice in today’s world. As we navigate through the intricacies of legacy and equity, we seek to uncover whether this conventional approach to inheritance is aligned with contemporary values or if it requires reevaluation in light of modern challenges.

Evaluating the Ethical Implications of Inheritance Practices

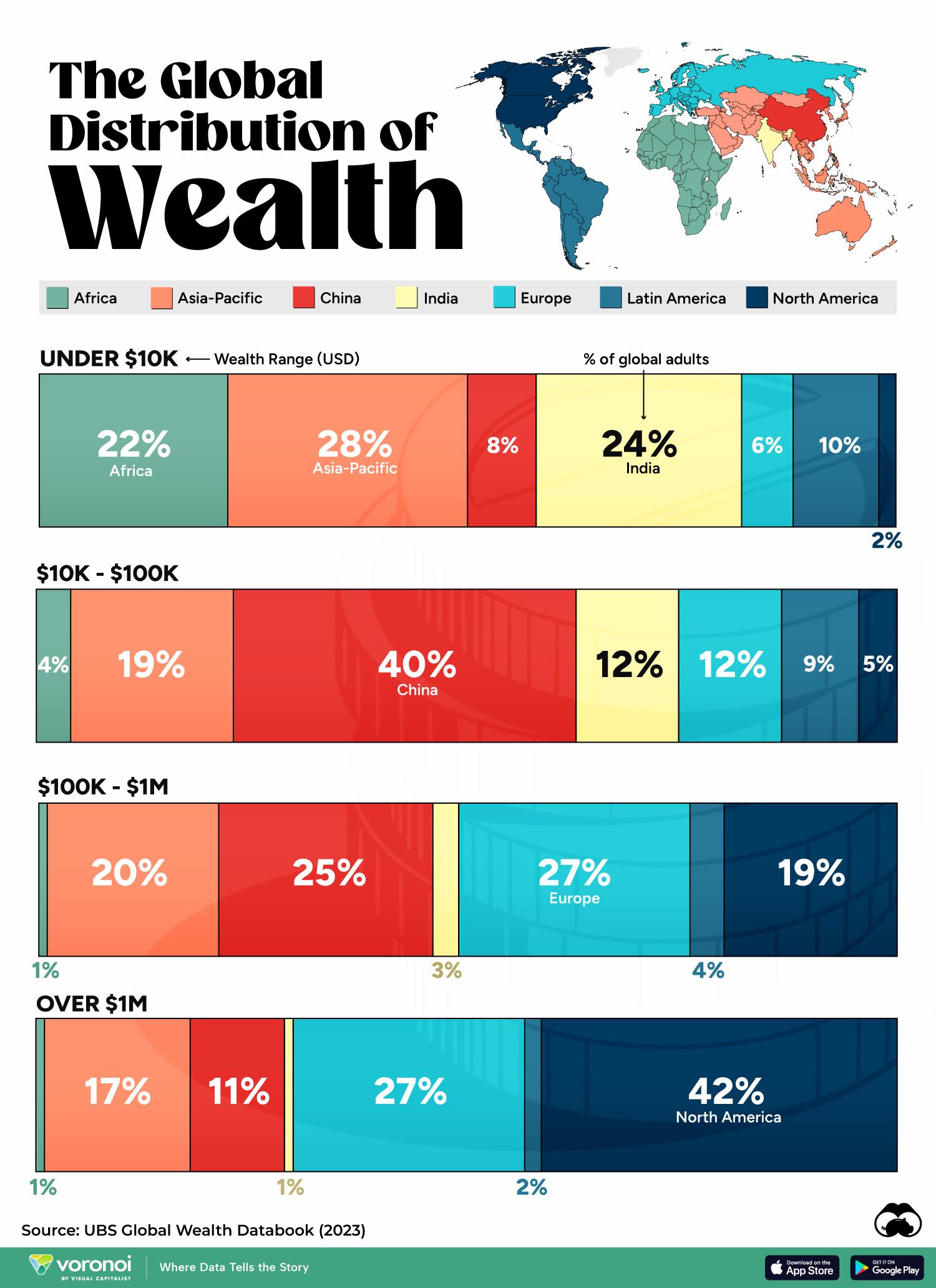

When examining the ethical dimensions of inheritance practices, several compelling arguments surface regarding the exclusive transfer of wealth to one’s offspring. While it is a natural inclination for parents to desire the financial security of their children, this practice can inadvertently perpetuate economic disparity and social stratification. Critics argue that such practices may contribute to the creation of a plutocracy, where wealth remains concentrated within a limited number of families, potentially stifling social mobility and fostering inequality.

From an ethical standpoint, the allocation of wealth could be reconsidered to foster a more equitable society. Here are a few points to consider:

- Social Responsibility: Some believe that wealth distribution should reflect a broader social obligation, where part of one’s estate benefits charitable causes or community projects.

- Meritocracy vs. Entitlement: Leaving wealth solely to descendants may undermine the principles of meritocracy, where individuals earn their success based on ability and effort, rather than inheritance.

- Legacy of Impact: Redirecting a portion of wealth towards societal development can create a lasting legacy that extends beyond familial boundaries, fostering innovation and positive change.

Ultimately, the ethical considerations of inheritance practices challenge individuals to reflect on the broader implications of their financial decisions, weighing personal desires against potential societal impacts.

Understanding the Societal Impact of Wealth Concentration

The concentration of wealth within a few families can lead to significant societal implications. This practice often results in the perpetuation of economic disparities, where a select few control a substantial portion of resources while many struggle with limited opportunities. Such concentration can stifle innovation and social mobility, leading to a society where merit and hard work may not guarantee success. As wealth remains locked within a small circle, it can contribute to the erosion of the middle class, which is often seen as the backbone of a stable and prosperous society.

Moreover, there are ethical considerations surrounding the exclusive inheritance of wealth by direct descendants. Critics argue that it can foster a sense of entitlement and discourage individual achievement. Here are some potential societal effects of this practice:

- Reduced Economic Mobility: With wealth staying within the family, it becomes harder for others to ascend the economic ladder.

- Increased Power Disparity: A few families may gain disproportionate influence over political and economic decisions.

- Stagnation of Innovation: When resources are concentrated, there’s less incentive to invest in new ideas or ventures.

Exploring Alternative Beneficiaries for Estate Planning

When contemplating the distribution of one’s estate, it is essential to consider the broader impact of wealth allocation. While it is a traditional choice to leave an estate solely to one’s children, diversifying beneficiaries can provide numerous advantages. By doing so, individuals can align their legacy with personal values and societal needs. Here are some alternative beneficiaries to consider:

- Charitable Organizations: Supporting causes that matter to you can ensure your wealth contributes to societal betterment.

- Educational Institutions: Endowments or scholarships can create lasting opportunities for future generations.

- Community Projects: Investing in local development can strengthen the community and foster positive change.

- Extended Family Members: Offering support to other relatives who may be in need can promote family unity and security.

- Friends or Caregivers: Acknowledging those who have played significant roles in your life can be a meaningful gesture of gratitude.

Choosing to extend the reach of your estate beyond direct descendants not only diversifies your legacy but also encourages a more holistic approach to wealth distribution. This strategy not only provides financial benefits to a broader group but also reflects a conscious effort to make a difference in the world.

Crafting a Balanced Approach to Wealth Distribution

In considering how to allocate one’s wealth, it is essential to weigh both personal desires and societal implications. Leaving your wealth exclusively to your children can seem like a natural choice, rooted in the instinct to provide for one’s family. However, this decision could inadvertently perpetuate economic inequality and hinder social mobility. Balancing personal legacy with broader societal benefits can lead to more equitable outcomes.

Here are some strategies for crafting a balanced approach:

- Charitable Contributions: Allocate a portion of your wealth to charities or causes that align with your values, promoting positive change and supporting those in need.

- Trust Funds with Purpose: Establish trust funds that incentivize your children to pursue education, entrepreneurship, or philanthropic efforts, rather than providing unrestricted access to wealth.

- Community Investments: Consider investing in community projects or social enterprises, which can offer returns while also benefiting society.

- Philanthropic Legacy: Create a family foundation that involves your children in charitable activities, fostering a sense of responsibility and empathy.

By thoughtfully considering these options, individuals can ensure their wealth contributes to a legacy of positive impact, while still supporting their family’s future.