In an era marked by economic uncertainty and fluctuating market dynamics, safeguarding family wealth against the erosive forces of inflation has become a paramount concern for many households. Inflation, often perceived as a silent predator, can steadily erode purchasing power, diminishing the real value of savings and investments over time. This analytical exploration seeks to unravel the complexities of inflation and its impact on family finances, providing a strategic roadmap for preserving and enhancing wealth amidst rising prices. With a confident approach, this article will delve into practical, evidence-based strategies that can empower families to not only protect their financial assets but also seize opportunities for growth in an inflationary environment. By understanding the mechanisms of inflation and implementing effective financial planning, families can ensure their economic stability and prosperity for future generations.

Understanding Inflation and Its Impact on Family Wealth

Inflation, the gradual increase in prices and decline in purchasing power, can significantly erode family wealth if not strategically managed. As costs rise, the value of cash savings can diminish, making it essential to adopt proactive measures to safeguard financial stability. Families must consider diversifying their investment portfolios to include assets that typically appreciate in value during inflationary periods. Real estate, stocks, and commodities are often viewed as hedges against inflation, providing potential growth and stability.

Additionally, it’s crucial to reassess and adjust financial plans regularly. Implementing a flexible budget can help manage increased living costs without compromising long-term financial goals. Families should focus on:

- Investing in inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS).

- Reducing high-interest debt to alleviate financial strain.

- Exploring income-generating opportunities that keep pace with inflation.

By understanding and adapting to the impacts of inflation, families can maintain and even enhance their wealth over time, ensuring financial security for future generations.

Strategic Asset Allocation to Safeguard Wealth

In the face of rising inflation, diversifying your investment portfolio becomes crucial to maintaining the purchasing power of your family’s wealth. A well-thought-out strategic asset allocation can act as a bulwark against inflationary pressures. Consider incorporating a mix of equities, bonds, real estate, and commodities. Each asset class reacts differently to inflation, offering a natural hedge when combined effectively.

Focus on the following components to fortify your financial strategy:

- Equities: Stocks, particularly those in companies with strong pricing power, can offer growth that outpaces inflation.

- Bonds: Inflation-linked bonds, such as TIPS, can provide income adjusted for inflationary changes.

- Real Estate: Properties can serve as tangible assets whose values often rise with inflation.

- Commodities: Investing in commodities like gold or oil can act as a safeguard, as their prices tend to increase when inflation rises.

By strategically balancing these elements, you can create a resilient investment portfolio designed to protect and grow your family’s wealth even in turbulent economic times.

Investing in Inflation-Resistant Assets for Long-Term Security

In the ever-fluctuating economic landscape, securing your family’s financial future requires strategic planning and investment in assets that withstand the erosive power of inflation. Real estate often stands out as a robust choice, providing both a hedge against inflation and a steady income stream through rental yields. Unlike stocks, which can be volatile in inflationary periods, real estate typically appreciates over time, ensuring your capital grows in tandem with inflation rates.

Another avenue to explore is precious metals such as gold and silver. Historically, these have been considered safe havens in times of economic uncertainty, maintaining their value when fiat currencies lose purchasing power. Additionally, investing in commodities—like agricultural products or energy resources—can provide a buffer against inflation, as their prices tend to rise when the cost of goods and services increases. For those looking to diversify further, consider Treasury Inflation-Protected Securities (TIPS), which are government bonds specifically designed to protect against inflation by adjusting their principal value in line with the Consumer Price Index.

- Real Estate: Provides capital growth and rental income.

- Precious Metals: Safe havens during economic uncertainty.

- Commodities: Price increase aligns with inflation.

- TIPS: Bonds adjusted to inflation rates.

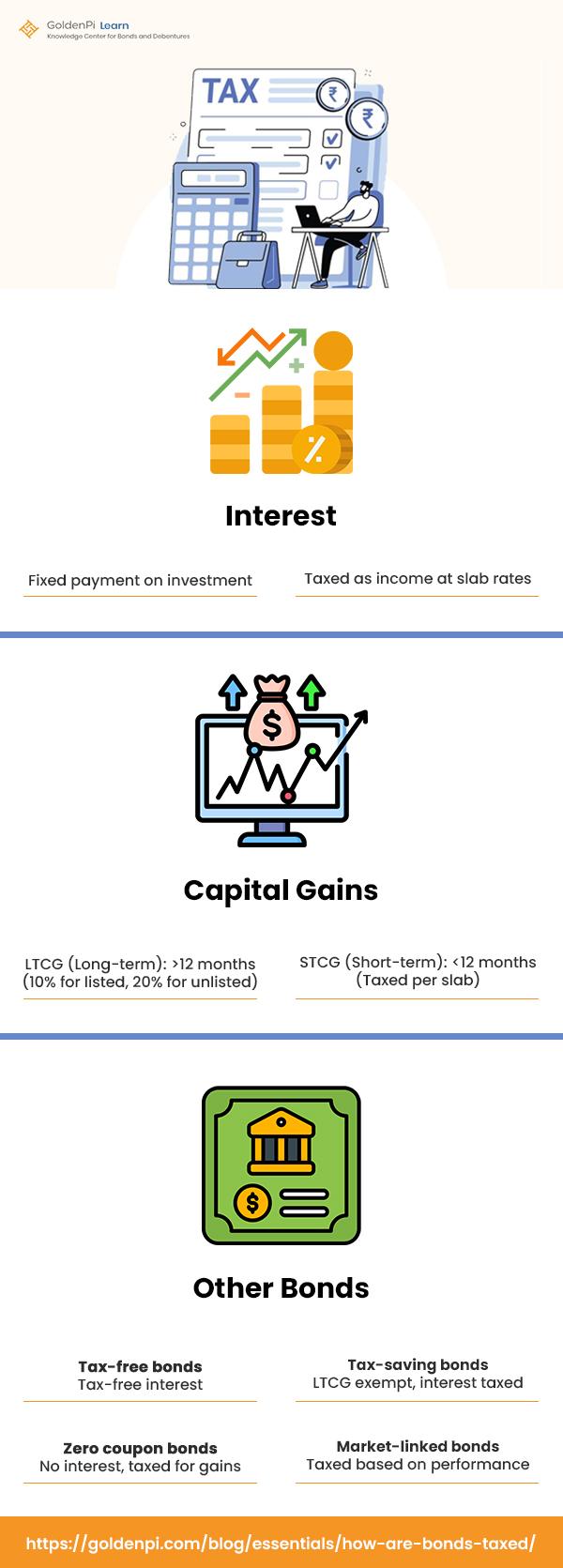

Utilizing Tax-Efficient Strategies to Preserve Family Wealth

Implementing tax-efficient strategies is a pivotal move in safeguarding your family’s financial legacy against the erosive effects of inflation. By optimizing the tax treatment of your investments and income, you can enhance the longevity and growth of your assets. Consider the following approaches to preserve wealth:

- Tax-Deferred Accounts: Maximize contributions to retirement accounts like 401(k)s and IRAs, where investments can grow tax-free until withdrawal.

- Tax-Efficient Fund Selection: Opt for index funds and ETFs that typically incur lower capital gains taxes compared to actively managed funds.

- Gifting Strategies: Utilize annual gift tax exclusions to transfer wealth to heirs without incurring significant tax liabilities.

- Charitable Contributions: Leverage charitable donations to reduce taxable income while supporting causes important to your family.

By integrating these methods into your financial planning, you not only mitigate the immediate impact of inflation but also ensure a robust financial future for generations to come.