In an era characterized by economic unpredictability and fluctuating financial markets, safeguarding family wealth has emerged as a paramount concern for many households. The turbulence of market volatility poses significant challenges to preserving assets and ensuring financial security for future generations. This article delves into strategic approaches to mitigate risks associated with market fluctuations, offering a comprehensive guide to fortifying family wealth. By examining a blend of traditional and innovative financial strategies, we aim to equip families with the knowledge and tools necessary to navigate the complexities of modern financial landscapes with confidence. From diversifying investment portfolios to exploring alternative asset classes, this analysis seeks to empower families to make informed decisions that protect their wealth against the ebbs and flows of market dynamics.

Diversifying Investments for Long-Term Stability

To safeguard family wealth from the unpredictability of market swings, it’s essential to explore a range of investment options. Diversification not only spreads risk but also positions a portfolio to seize growth opportunities in various economic climates. Consider including a mix of asset classes such as:

- Stocks: While they can be volatile, equities offer the potential for high returns over the long term.

- Bonds: These can provide steady income and are generally less risky than stocks.

- Real Estate: Property investments can offer both rental income and capital appreciation.

- Commodities: Assets like gold or oil can serve as a hedge against inflation and currency fluctuations.

- Alternative Investments: Consider hedge funds, private equity, or venture capital to tap into non-traditional growth sectors.

Beyond diversifying across asset classes, geographic diversification can also play a crucial role. Investing in international markets allows access to different economic cycles and growth trajectories, further stabilizing a family’s wealth. Global diversification ensures that the portfolio is not overly reliant on the performance of a single country’s economy, offering an additional layer of protection against localized downturns.

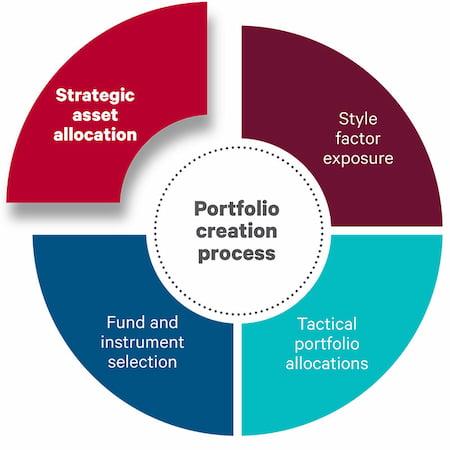

Implementing Strategic Asset Allocation Techniques

Strategic asset allocation is a cornerstone in safeguarding family wealth against the unpredictable tides of market fluctuations. This approach involves setting a long-term asset mix that aligns with your family’s financial goals and risk tolerance. By diversifying investments across various asset classes—such as equities, bonds, real estate, and alternative investments—you can mitigate risks and harness growth opportunities. The key lies in maintaining a balanced portfolio that is periodically reviewed and adjusted in response to economic changes and family circumstances.

- Risk Assessment: Evaluate your family’s financial goals and risk tolerance to determine an appropriate asset mix.

- Portfolio Diversification: Spread investments across different asset classes to reduce exposure to any single market sector.

- Regular Rebalancing: Adjust the asset allocation periodically to reflect changes in market conditions and personal financial objectives.

- Incorporating Alternative Investments: Consider assets like hedge funds or private equity for potential higher returns and added diversification.

Utilizing Trusts and Estate Planning for Wealth Preservation

In an unpredictable economic landscape, leveraging trusts and strategic estate planning can serve as a robust shield against market fluctuations, ensuring the longevity of family wealth. Trusts offer a flexible and efficient means to manage and distribute assets, while simultaneously minimizing tax liabilities and safeguarding your legacy from creditors. By placing assets into a trust, you can dictate the terms under which beneficiaries receive distributions, thus preventing impulsive financial decisions during volatile periods. Estate planning, when done meticulously, encompasses a wide array of tools designed to preserve wealth. These include irrevocable life insurance trusts, dynasty trusts, and charitable remainder trusts, each offering unique benefits tailored to protect against market volatility.

Moreover, estate planning is not a one-time activity but a dynamic process that should be revisited regularly to adapt to changing laws and financial circumstances. Consider the following strategies to enhance your wealth preservation plan:

- Diversify assets across different classes and geographical regions to reduce exposure to market risks.

- Utilize tax-efficient vehicles to minimize the impact of market downturns on your estate’s value.

- Incorporate philanthropic strategies to both preserve wealth and fulfill charitable goals, potentially reducing estate taxes.

By integrating these strategies into your estate planning efforts, you can create a resilient financial framework that not only withstands market turbulence but also fosters long-term wealth accumulation for future generations.

Leveraging Insurance Solutions to Mitigate Financial Risks

In today’s ever-changing economic landscape, safeguarding family wealth requires strategic planning and informed decision-making. One effective approach is to utilize insurance solutions that can serve as a financial safety net. These solutions offer a multitude of benefits, including risk diversification and asset protection, which are essential in mitigating the effects of market volatility. By incorporating insurance products such as life insurance, annuities, and long-term care insurance into your financial plan, you can create a buffer against unforeseen economic downturns.

- Life Insurance: Provides a death benefit that can replace lost income and ensure financial stability for your family.

- Annuities: Offer a steady income stream, helping to protect against the risk of outliving your assets.

- Long-Term Care Insurance: Covers the costs of long-term care services, safeguarding your savings and investments from being depleted.

These insurance solutions not only help in preserving wealth but also allow for strategic estate planning, ensuring that your family’s financial legacy is protected for future generations. By leveraging these products, you can confidently navigate the uncertainties of the financial markets and maintain a resilient financial portfolio.