In an era where traditional investment vehicles face increasing volatility, the allure of alternative assets has never been more pronounced. Among these, art and collectibles stand out as intriguing options for families looking to diversify their portfolios and build generational wealth. This analytical exploration delves into the nuanced world of investing in art and collectibles, offering a strategic guide to understanding their potential and pitfalls. By examining market trends, historical performance, and expert insights, this article aims to equip you with the knowledge and confidence to navigate this complex yet rewarding investment landscape. Whether you’re an experienced investor or a newcomer seeking to enrich your family’s financial legacy, understanding the intricacies of art and collectibles can open doors to both aesthetic and economic appreciation.

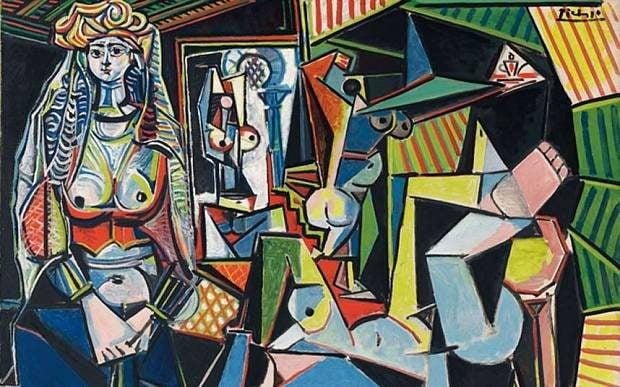

Identifying Valuable Art and Collectibles for Investment

Investing in art and collectibles requires a discerning eye and an understanding of what makes certain pieces valuable. Rarity is a key factor; limited editions or one-of-a-kind works often appreciate more over time. Additionally, provenance—the history of a piece’s ownership—can significantly influence its value. Art with a well-documented background tends to attract more serious investors. Condition is another critical element; items in pristine condition generally command higher prices.

- Market Trends: Staying informed about current trends can guide your investment choices. Emerging artists or popular styles can be lucrative.

- Artist Reputation: The reputation and recognition of an artist play a crucial role. Established artists usually offer more stable investment opportunities.

- Cultural Significance: Art that holds cultural or historical significance often gains value as its relevance persists over time.

By focusing on these elements, you can better identify pieces that not only appeal aesthetically but also offer potential for long-term financial growth.

Understanding Market Trends and Timing Your Purchases

When it comes to investing in art and collectibles, understanding market trends is crucial for maximizing returns and safeguarding family wealth. The art market, much like the stock market, is influenced by a myriad of factors including economic conditions, cultural shifts, and even technological advancements. Identifying trends can offer valuable insights; for example, the rise in popularity of digital art and NFTs has reshaped the landscape, creating new opportunities for investors. Analyzing past sales data and keeping an eye on upcoming exhibitions can help you anticipate shifts and act accordingly.

- Follow auction house reports and market analyses for current trends.

- Network with industry experts and attend art fairs to gain firsthand insights.

- Consider the impact of cultural and technological trends on the value of art and collectibles.

Timing your purchases is another critical element of building a robust collection. Art and collectibles often appreciate over time, but the key is knowing when to buy. During economic downturns, prices may dip, offering an opportunity to acquire valuable pieces at a lower cost. Conversely, in booming markets, it might be wise to hold off on new acquisitions unless they offer exceptional value or potential for appreciation. The goal is to buy low and sell high, a principle that holds true across all investment types.

Diversifying Your Collection to Mitigate Risk

Investing in art and collectibles can be a lucrative way to build family wealth, but it’s crucial to spread your investments across different categories to minimize potential risks. Diversification is the key strategy here. Instead of concentrating solely on paintings, consider branching out into other forms of art like sculptures, photography, or even digital art, which has been gaining momentum with the rise of NFTs. Collectibles such as vintage wines, rare coins, or classic cars can also offer significant returns and add a layer of diversity to your portfolio.

By including a variety of assets, you not only increase the potential for higher returns but also safeguard against market volatility. Art markets can be unpredictable, with trends shifting rapidly. A well-diversified collection ensures that if one sector underperforms, others may compensate for it. Consider the following avenues for diversification:

- Genre: Explore different art movements and styles.

- Medium: Invest in both physical and digital art forms.

- Geography: Collect works from artists around the world.

- Era: Balance contemporary pieces with historical artifacts.

By embracing a broad spectrum of opportunities, you can effectively build a resilient collection that withstands market fluctuations and contributes to sustained family wealth.

Establishing a Long-Term Strategy for Family Wealth Preservation

When considering art and collectibles as part of a family’s long-term wealth strategy, it is crucial to recognize the unique benefits and challenges these assets present. Unlike traditional financial instruments, art and collectibles can provide both cultural enrichment and substantial financial returns. To maximize these benefits, families should focus on diversification and provenance. Diversifying across different art forms and collectible categories—such as paintings, sculptures, rare coins, and vintage wines—can help mitigate risks associated with market fluctuations. Meanwhile, ensuring a clear provenance or ownership history not only adds to the value of the item but also provides assurance against potential legal disputes.

To effectively integrate art and collectibles into a family wealth preservation plan, it’s essential to adopt a strategic approach. This includes:

- Education and Expertise: Investing in knowledge by consulting with art advisors and attending auctions or galleries can provide valuable insights into market trends.

- Long-Term Vision: Art and collectibles often appreciate over time, so patience and a long-term holding strategy are key.

- Proper Documentation: Keeping meticulous records of purchase receipts, appraisal reports, and authenticity certificates ensures smooth future transactions.

- Insurance and Security: Protecting these assets with appropriate insurance and secure storage solutions safeguards against unforeseen events.

By aligning these strategies with the family’s overall wealth goals, art and collectibles can serve as a powerful tool for preserving wealth across generations.