In today’s complex financial landscape, achieving a balance between saving and spending is not just a personal challenge but a critical component of family financial health. With economic uncertainties looming and the cost of living on the rise, families are increasingly confronted with the task of managing their finances wisely. This requires a strategic approach that goes beyond simple budgeting; it demands an analytical understanding of financial dynamics and a confident application of money management principles. By examining key factors such as income, expenses, savings goals, and investment opportunities, families can craft a sustainable financial plan that ensures stability and growth. This article delves into the essential strategies and tools necessary to strike an optimal balance, empowering families to secure their financial future while enjoying the present.

Understanding Your Familys Financial Landscape

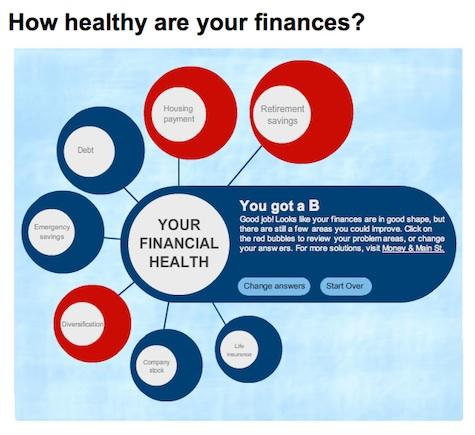

Creating a robust financial strategy for your family requires a thorough examination of both saving and spending habits. It’s essential to first assess your current financial status by taking into account all sources of income, regular expenses, and any existing debts. Once you have a clear picture, set realistic financial goals that align with your family’s needs and aspirations. These could range from saving for a child’s education to planning a dream family vacation. Implementing a balanced approach ensures that you are prepared for unforeseen circumstances while still enjoying life’s pleasures.

To effectively manage this balance, consider these strategies:

- Automate Savings: Set up automatic transfers to a dedicated savings account to ensure you consistently save a portion of your income.

- Budget Mindfully: Create a flexible budget that accommodates both essential expenses and discretionary spending, allowing room for adjustments as needed.

- Regular Financial Check-ins: Schedule periodic reviews of your financial plan to track progress and make necessary adjustments.

By understanding and actively managing your family’s financial landscape, you pave the way for financial health and peace of mind.

Strategic Budgeting for Long-Term Security

Ensuring a stable financial future for your family hinges on implementing a strategic approach to budgeting. This involves not just cutting costs, but also allocating resources effectively to meet both immediate needs and long-term goals. The key is to establish a balance between saving and spending that aligns with your family’s unique financial landscape. Start by identifying essential expenditures, such as housing, food, and healthcare, and set aside funds for these necessities first. Then, focus on building a robust emergency fund, which acts as a financial buffer against unforeseen circumstances.

Incorporating strategic investments into your budgeting plan is equally crucial for long-term security. Consider the following approaches:

- Prioritize Debt Reduction: Allocate a portion of your budget to pay down high-interest debts, freeing up future income.

- Diversify Savings: Split savings into different accounts, such as retirement funds, education savings, and short-term reserves.

- Monitor and Adjust: Regularly review your budget and financial goals, making adjustments as necessary to stay on track.

By adopting a forward-thinking mindset and a disciplined approach to budgeting, you can safeguard your family’s financial health and pave the way for a secure future.

Smart Spending: Prioritizing Needs Over Wants

When it comes to managing family finances, the line between needs and wants can often blur, leading to unnecessary spending and financial strain. Prioritizing needs is a strategic approach that involves assessing the essentials required for your family’s well-being. These essentials typically include housing, utilities, groceries, healthcare, and education. By focusing on these core necessities, you can allocate your resources more effectively, ensuring that the foundation of your family’s financial health remains stable.

Once the needs are accounted for, it’s crucial to address the temptation of wants. While it’s natural to desire non-essential items, such as the latest gadgets or dining out, these should be considered luxuries that fit within a carefully planned budget. Here are some tips to help you differentiate and prioritize:

- Evaluate the impact: Consider how each purchase will affect your family’s financial goals.

- Set boundaries: Define a clear budget for discretionary spending to avoid impulsive buys.

- Practice delayed gratification: Wait a week before making a non-essential purchase to see if it’s truly important.

By mastering the art of smart spending, you not only safeguard your family’s financial health but also cultivate a mindset that values long-term security over short-term indulgence.

Building a Robust Emergency Fund

Creating a safety net for unexpected financial surprises is crucial to maintaining a healthy family budget. A well-structured emergency fund acts as a financial buffer, providing peace of mind and stability. Start by assessing your family’s monthly expenses and aim to save enough to cover three to six months’ worth. This target can vary depending on individual circumstances, such as job security and health conditions. To begin building this fund, consider automating transfers to a dedicated savings account each month. This approach not only ensures consistent saving but also reduces the temptation to spend.

- Prioritize Essentials: Focus on cutting back non-essential expenses to increase your savings capacity. This might include dining out less frequently or reducing entertainment costs.

- Leverage Windfalls: Use bonuses, tax refunds, or any unexpected income to boost your emergency fund. Treat these as opportunities to fortify your financial foundation.

- Regularly Review and Adjust: Periodically reassess your financial situation and adjust your savings goals accordingly. Family dynamics and needs change, and your emergency fund should reflect these shifts.