In today’s rapidly evolving educational landscape, parents face an increasingly complex financial puzzle when opting to enroll multiple children in private schools. This decision, often driven by the desire to provide superior educational opportunities, necessitates a strategic approach to financial planning. The commitment to private education, while rewarding, demands a nuanced understanding of budgeting, investment, and long-term financial management. This article delves into the intricacies of financial planning for families navigating the challenges of private schooling for multiple children. With a confident and analytical lens, we explore effective strategies to balance immediate educational expenses with broader financial goals, ensuring that families can sustain this investment without compromising their financial stability. From tuition costs and extracurricular fees to potential financial aid options, this guide aims to equip parents with the knowledge and tools necessary to make informed decisions, ultimately fostering an environment where educational aspirations and financial well-being coexist harmoniously.

Evaluating the True Cost of Private Education

Understanding the financial implications of enrolling multiple children in private schools is crucial for effective financial planning. While the perceived benefits of private education—such as smaller class sizes, specialized programs, and enhanced facilities—are often highlighted, it’s essential to delve deeper into the true cost associated with these choices. Parents should consider not only the tuition fees but also additional expenses such as uniforms, extracurricular activities, transportation, and potential increases in fees over time.

- Tuition and Fees: The baseline cost, often subject to annual increases, can vary significantly between institutions.

- Additional Expenses: Include costs for uniforms, sports equipment, field trips, and any technology fees.

- Sibling Discounts: Investigate if schools offer any discounts for multiple enrollments, which can alleviate some financial pressure.

- Financial Aid Opportunities: Explore scholarships or grants that may be available to reduce the financial burden.

By analyzing these factors, parents can better prepare for the financial commitment of private education and make informed decisions that align with their long-term financial goals. Balancing aspirations for quality education with fiscal responsibility is key to sustaining this investment over time.

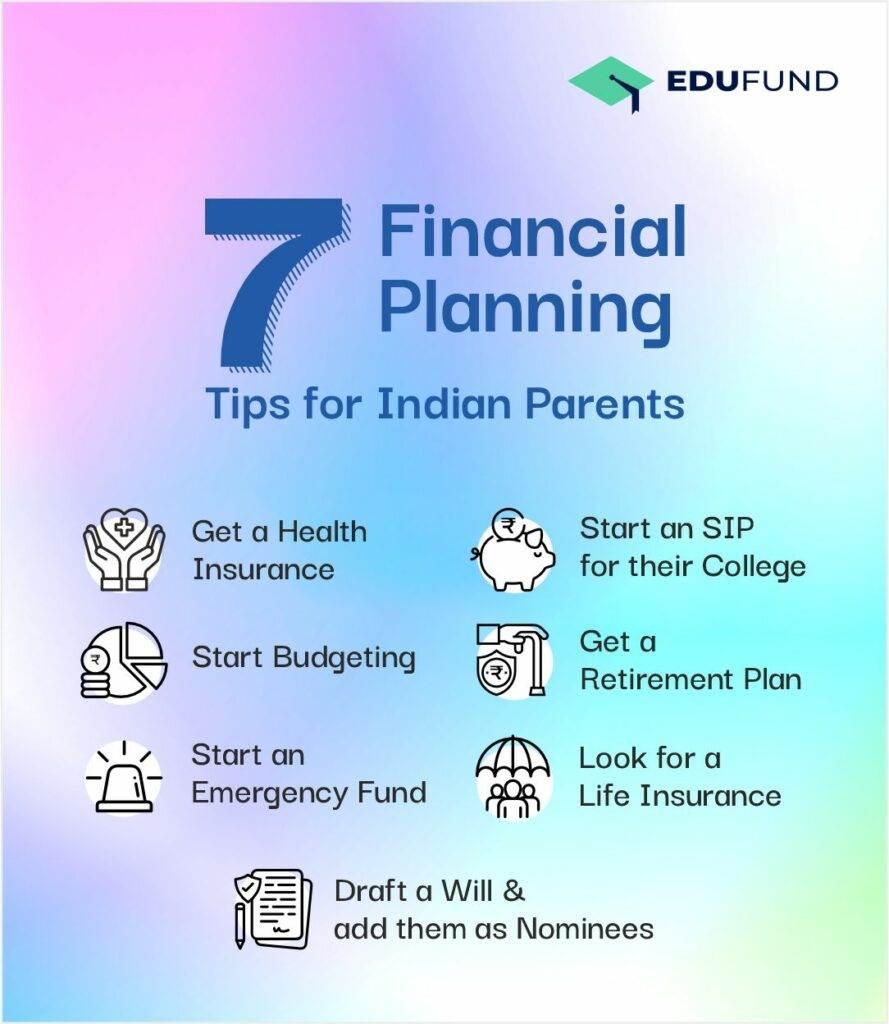

Strategic Budgeting for Families with Multiple Students

When it comes to financing private education for multiple children, strategic budgeting becomes an essential skill for families. The key lies in creating a flexible yet comprehensive plan that can accommodate the various financial demands associated with private schooling. Begin by evaluating each child’s educational needs and potential expenses, such as tuition fees, uniform costs, and extracurricular activities. It’s beneficial to create a detailed spreadsheet or utilize budgeting software to keep track of these costs and identify potential areas for savings.

Consider leveraging financial aid opportunities and scholarships, which many private schools offer. Families can also benefit from exploring tax-advantaged savings plans, such as 529 plans, to ease the financial burden. Additionally, involving older children in financial discussions can foster a sense of responsibility and help them understand the importance of budgeting. Key strategies include:

- Prioritizing expenses based on necessity and long-term benefits.

- Setting up a dedicated education fund to systematically save for future costs.

- Negotiating payment plans or discounts directly with the school administration.

With a proactive approach and a well-structured budget, parents can navigate the complexities of private school expenses while ensuring their children receive the best possible education.

Maximizing Education Savings Plans and Tax Benefits

Parents with multiple children in private schools can strategically leverage education savings plans to alleviate financial pressures while maximizing tax benefits. Utilizing options like 529 plans or Coverdell Education Savings Accounts can offer significant advantages. These plans allow for tax-free growth and withdrawals when funds are used for qualified education expenses, including tuition, books, and supplies. By investing in these plans early and regularly, parents can potentially reduce their taxable income, thereby enhancing their overall financial strategy.

Consider the following strategies to optimize these benefits:

- Stagger Contributions: Spread out contributions across different plans to match each child’s anticipated education timeline, ensuring consistent growth potential and tax advantages.

- Take Advantage of State Tax Deductions: Some states offer tax deductions or credits for contributions to state-sponsored education savings plans, providing an additional layer of savings.

- Coordinate with Gift Tax Exclusions: Utilize the annual gift tax exclusion to fund education savings plans, which allows for tax-free contributions up to a certain limit per year, per child.

Tailoring Investment Strategies to Support Long-Term Educational Goals

When managing the financial landscape for families with multiple children in private education, a strategic approach to investment becomes imperative. Parents must navigate the delicate balance between current educational expenses and future financial stability. By diversifying investments, families can create a robust financial plan that adapts to changing circumstances. Consider allocating funds into a mix of stocks, bonds, and mutual funds to ensure growth potential while maintaining a buffer against market volatility. Tax-advantaged accounts, such as 529 plans, offer a strategic advantage by providing tax-free growth when used for educational purposes, thus maximizing the value of every dollar saved.

Practical steps to align investments with educational goals include:

- Regularly reviewing and adjusting portfolios to reflect changing market conditions and family needs.

- Setting up automatic contributions to savings accounts dedicated to educational expenses.

- Exploring scholarships and financial aid options to alleviate some of the financial burdens.

By taking these measures, parents can support their children’s educational aspirations while securing a stable financial future.