In the rapidly evolving landscape of personal finance, traditional savings accounts have long been considered a cornerstone of wealth management. These accounts, once lauded for their safety and reliability, now face scrutiny in an era characterized by unprecedented technological advancement and shifting economic paradigms. As digital banking platforms, cryptocurrencies, and investment apps proliferate, the relevance of conventional savings vehicles is increasingly called into question. This article delves into the evolving role of traditional savings accounts within the broader spectrum of wealth management, examining whether their benefits can still outweigh the allure of higher-yielding, innovative alternatives. Through a critical analysis of current financial trends and consumer behaviors, we aim to uncover whether these once-indispensable tools are becoming obsolete or merely adapting to the demands of a new financial age.

Examining the Role of Traditional Savings Accounts in Modern Wealth Management

In the landscape of modern wealth management, traditional savings accounts hold a unique position. While they may not offer the high returns seen in investments like stocks or real estate, their role should not be underestimated. Security is one of their most significant advantages. Unlike more volatile investment options, savings accounts provide a stable, low-risk environment for storing funds, making them an attractive choice for individuals prioritizing capital preservation over growth.

Moreover, traditional savings accounts can serve as a vital component in a diversified portfolio. Consider these benefits:

- Liquidity: Quick access to funds without penalties, ideal for emergencies or short-term needs.

- Predictability: Fixed interest rates and insured deposits offer a reliable income stream.

- Foundation for Financial Goals: Provides a safe starting point for those beginning their wealth-building journey.

While they may not be the most glamorous option, traditional savings accounts continue to play a crucial role in a balanced wealth management strategy.

Analyzing Interest Rates and Inflation Impact on Savings Account Viability

In the current financial landscape, the dual forces of fluctuating interest rates and rising inflation have a profound impact on the viability of traditional savings accounts. As central banks adjust interest rates to manage economic stability, these changes directly affect the returns savers can expect from their deposits. Low-interest rates often mean that the returns on savings accounts are meager, potentially failing to keep pace with inflation. This scenario results in a gradual erosion of the purchasing power of money kept in these accounts, as the rate of inflation outstrips the interest earned.

Moreover, high inflation exacerbates the issue by increasing the cost of living, prompting individuals to rethink the effectiveness of savings accounts as a wealth management tool. Savers are now considering alternative options that may offer better protection against inflationary pressures, such as:

- Investment in stocks or mutual funds: While riskier, they often provide higher returns over the long term.

- Real estate: Seen as a hedge against inflation due to property value appreciation.

- Cryptocurrencies and digital assets: Gaining popularity for their potential high returns, albeit with significant volatility.

The landscape of wealth management is evolving, and the traditional savings account is being scrutinized more than ever for its ability to preserve and grow wealth in a challenging economic environment.

Exploring Alternatives: High-Yield Savings and Investment Accounts

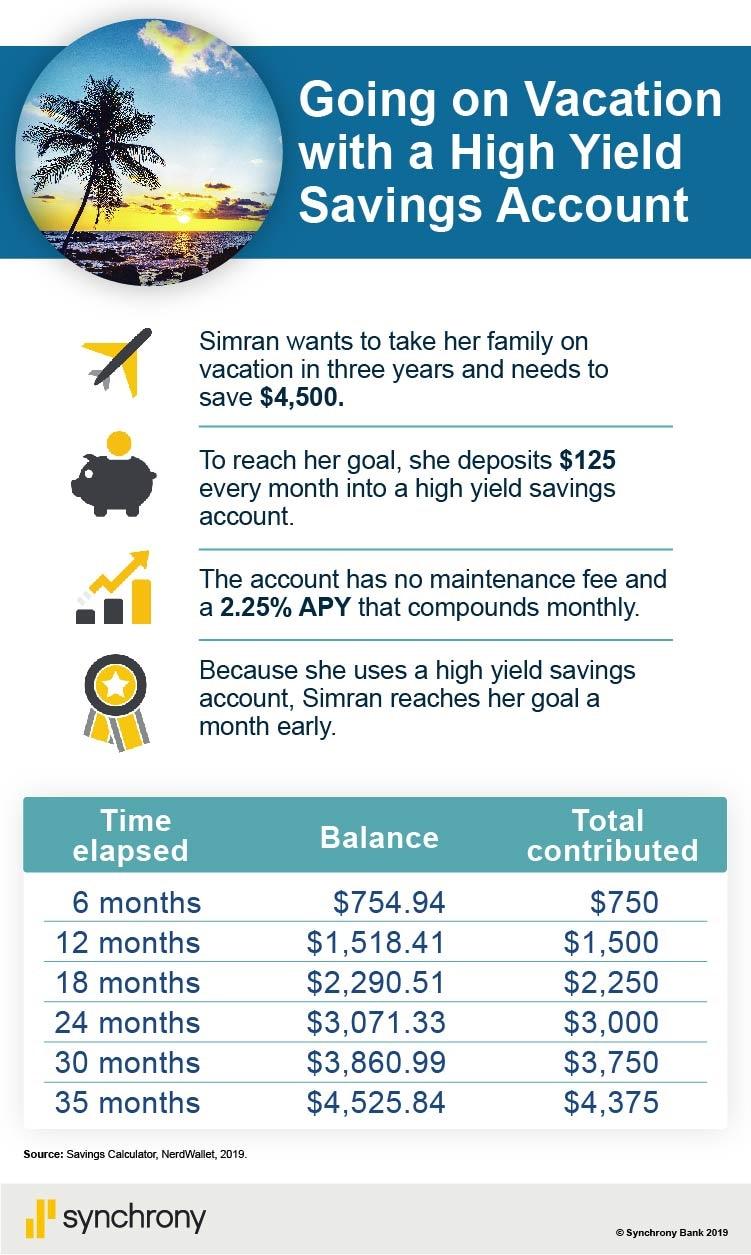

As the financial landscape continues to evolve, individuals are increasingly considering high-yield savings accounts and investment accounts as viable alternatives to traditional savings methods. These modern options offer attractive benefits that could potentially outpace the modest returns of conventional savings accounts. High-yield savings accounts, for instance, often provide interest rates that are significantly higher than those offered by traditional banks. This makes them an appealing choice for those looking to grow their savings with minimal risk.

Meanwhile, investment accounts open the door to a range of opportunities for wealth accumulation, albeit with varying degrees of risk. Key advantages include:

- Diversification: Investment accounts allow for a diverse portfolio, balancing risk across multiple asset classes.

- Potential for Higher Returns: Unlike the static interest rates of savings accounts, investments can yield higher returns over time.

- Tax Benefits: Certain investment accounts offer tax advantages that can enhance overall financial strategy.

In light of these benefits, it’s clear that high-yield savings and investment accounts are not just alternatives but powerful tools in modern wealth management.

Strategic Recommendations for Optimizing Personal Wealth Portfolios

In the evolving landscape of wealth management, a strategic reassessment of personal wealth portfolios is imperative to harness optimal growth. While traditional savings accounts have been a staple, their minimal interest rates in today’s low-yield environment necessitate a shift towards more dynamic financial instruments. Diversification remains the cornerstone of a resilient portfolio, incorporating a blend of assets that can include:

- Stocks and Bonds: Offering potential for higher returns while balancing risk.

- Real Estate: Providing tangible asset value and rental income opportunities.

- Cryptocurrencies: Presenting high-risk, high-reward scenarios with a growing acceptance in mainstream finance.

- Exchange-Traded Funds (ETFs): Allowing exposure to diverse markets with lower costs and flexibility.

Embracing a more comprehensive approach, including these varied asset classes, can better position investors to achieve their financial goals. Furthermore, leveraging automated financial tools and robo-advisors can offer personalized insights and real-time adjustments to portfolio strategies, ensuring alignment with market conditions and personal risk tolerance. In this dynamic economic climate, adaptability and informed decision-making are paramount to sustaining and growing personal wealth.