In today’s rapidly evolving economic landscape, the importance of a robust financial strategy for your family cannot be overstated. Crafting a long-term financial plan is not merely about budgeting or saving; it is a comprehensive approach to securing your family’s financial future amidst uncertainties. This analytical guide delves into the essential components of a successful financial plan, offering insights into effective goal-setting, risk management, and investment strategies tailored to your family’s unique needs. With confidence, we will explore how to navigate the complexities of financial planning, empowering you to make informed decisions that will safeguard your family’s prosperity for generations to come.

Assessing Your Current Financial Situation

Before embarking on the journey of creating a long-term financial plan for your family, it’s crucial to take a step back and evaluate where you currently stand financially. This assessment acts as the foundation for all future financial decisions. Start by gathering all relevant financial documents, such as bank statements, credit card bills, loan agreements, and investment portfolios. Organize these documents to get a clear picture of your assets, liabilities, income, and expenses. This process will help you identify any financial gaps and areas that need improvement.

- Assets: List everything you own, including savings, investments, real estate, and valuable possessions.

- Liabilities: Account for all your debts, such as mortgages, loans, and credit card balances.

- Income: Calculate your total household income from all sources, including salaries, bonuses, and passive income.

- Expenses: Track your spending patterns to understand where your money goes each month.

By thoroughly analyzing these components, you can uncover insights into your financial health and identify patterns that could impact your long-term goals. This exercise not only sets a baseline for your financial plan but also empowers you to make informed decisions with confidence.

Setting Clear and Achievable Financial Goals

When establishing financial targets for your family, it’s crucial to ensure that they are both clear and achievable. Start by identifying what truly matters to your family, whether it’s buying a home, saving for college, or ensuring a comfortable retirement. Clarity in goals allows you to break them down into manageable steps and allocate resources effectively. To achieve this, consider the following:

- Define Specific Goals: Instead of vague objectives like “save money,” specify the amount and purpose, such as “save $20,000 for a down payment on a house.”

- Set Realistic Timelines: Align your goals with realistic timeframes. For example, if your goal is to pay off debt, calculate a feasible monthly payment plan that won’t strain your budget.

- Prioritize Your Goals: Understand which goals are most urgent and important. This prioritization will guide your financial decisions and resource allocation.

- Regularly Review and Adjust: Life is dynamic, and so should be your financial plan. Regularly assess your progress and adjust your goals as needed to stay on track.

By adopting a structured approach to setting financial goals, your family can navigate the complexities of long-term planning with confidence and clarity.

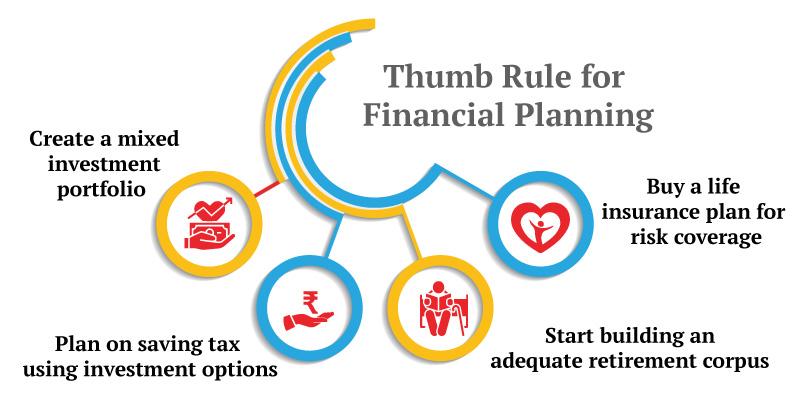

Developing a Comprehensive Savings and Investment Strategy

Crafting a robust savings and investment plan is essential for ensuring your family’s financial security and growth over the long term. Begin by assessing your current financial situation, taking into account all income sources, expenses, debts, and existing savings. Understanding your financial baseline is crucial for setting realistic goals. Once you’ve established this foundation, focus on building an emergency fund to cover unexpected expenses, which should ideally cover three to six months of living costs.

With a safety net in place, turn your attention to investments that align with your family’s goals and risk tolerance. Diversify your portfolio to include a mix of asset classes such as stocks, bonds, and real estate. This can help mitigate risk while maximizing potential returns. Consider the following strategies:

- Regularly review and adjust your portfolio to align with market conditions and personal circumstances.

- Leverage tax-advantaged accounts like IRAs or 529 plans to optimize savings for retirement and education.

- Automate contributions to ensure consistent savings and investments over time.

By taking these steps, you can create a dynamic and resilient financial strategy that not only protects your family’s current lifestyle but also builds a legacy for future generations.

Implementing Risk Management and Insurance Solutions

Developing a robust strategy to safeguard your family’s financial future involves meticulous planning and the integration of comprehensive risk management and insurance solutions. Understanding potential risks and proactively addressing them is essential to ensure that unforeseen events do not derail your financial goals. Begin by assessing your family’s unique needs and potential vulnerabilities, such as health issues, job instability, or property damage. This evaluation should guide your choice of insurance policies, from life and health insurance to home and auto coverage.

- Diversify your insurance portfolio: Don’t rely solely on one type of insurance; consider a mix that covers various aspects of your life.

- Regularly review and adjust policies: As your family grows and circumstances change, ensure that your insurance coverage evolves accordingly.

- Engage with a professional: Consulting with an insurance advisor can provide insights tailored to your family’s specific situation, helping you navigate complex policy options.

Incorporating these strategies into your long-term financial plan not only offers peace of mind but also fortifies your family’s financial resilience against life’s uncertainties.