In today’s ever-evolving financial landscape, safeguarding family wealth is more crucial than ever. With economic uncertainties and market volatility becoming the norm, strategic investment planning is essential to ensure the longevity and security of familial assets. This article delves into five pivotal investment tips designed to protect and enhance family wealth, providing a robust framework for navigating the complexities of modern finance. Drawing on expert insights and analytical perspectives, we will explore strategies that balance risk and reward, offering a confident approach to wealth preservation. Whether you’re a seasoned investor or just beginning to build your family’s financial future, these tips aim to equip you with the knowledge and tools necessary to make informed, resilient investment decisions.

Diversifying Assets to Mitigate Risk

In the ever-evolving landscape of investment, relying solely on a single asset class can be perilous. To safeguard family wealth, it is crucial to embrace a strategy that spreads risk across various asset types. This approach not only cushions against market volatility but also taps into multiple avenues of potential growth. Consider integrating a mix of the following assets into your portfolio:

- Equities: Stocks offer the potential for high returns, though they come with increased risk. A balanced selection across sectors can provide both stability and growth.

- Bonds: Often seen as a safer bet, bonds can offer regular income and act as a counterbalance to the more volatile equity market.

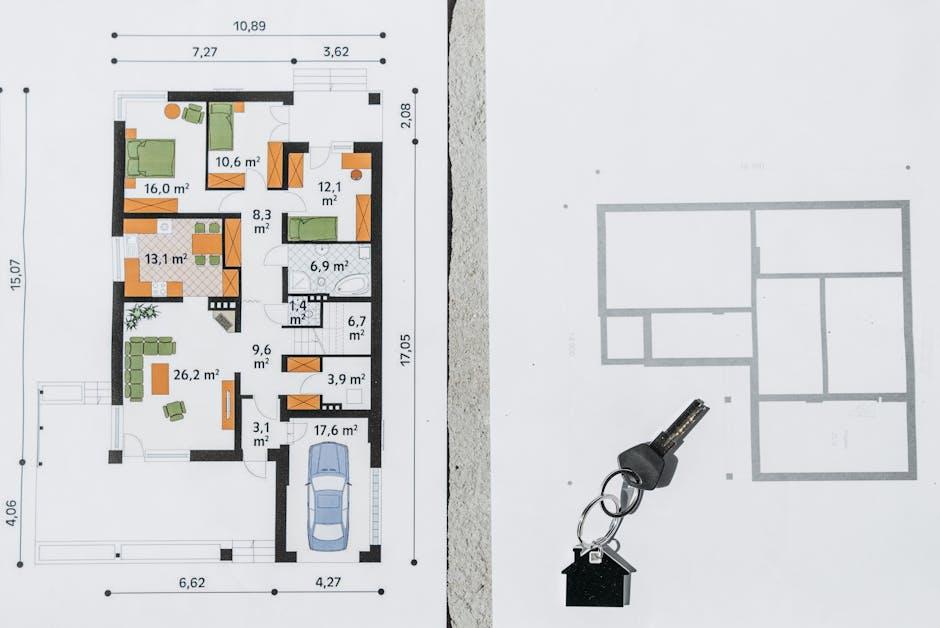

- Real Estate: Property investment provides tangible assets that can yield rental income and appreciate over time.

- Commodities: Investing in physical goods like gold or oil can hedge against inflation and currency devaluation.

- Alternative Investments: Assets such as hedge funds, private equity, or even cryptocurrencies offer diversification beyond traditional markets.

By diversifying your asset base, you not only spread risk but also position your family’s wealth to withstand economic uncertainties and capitalize on diverse market opportunities.

Harnessing Tax-Advantaged Accounts for Long-Term Growth

Maximizing the benefits of tax-advantaged accounts is a powerful strategy for ensuring your family’s financial future. These accounts, such as 401(k)s, IRAs, and 529 plans, offer unique opportunities to grow your investments with tax-deferred or tax-free growth. By leveraging these accounts, you can significantly reduce your taxable income today while building a robust nest egg for tomorrow.

- 401(k) and IRA Contributions: Take full advantage of employer matching contributions and annual contribution limits to enhance your retirement savings.

- Roth IRA Conversions: Consider converting traditional IRAs to Roth IRAs during lower income years to benefit from tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs): Utilize HSAs not only for medical expenses but also as a tax-efficient investment vehicle for long-term savings.

- Education Savings with 529 Plans: Invest in your children’s future education costs with tax-free growth and withdrawals for qualified expenses.

By strategically managing these accounts, you can achieve substantial long-term growth while safeguarding your wealth from unnecessary tax burdens.

Leveraging Estate Planning to Secure Future Generations

When it comes to safeguarding your family’s financial legacy, incorporating strategic investments within your estate plan is paramount. Consider diversifying your portfolio to include a mix of asset classes that can withstand market fluctuations. Real estate, stocks, and bonds each offer unique advantages and risks; a balanced approach can help mitigate potential losses. Additionally, investing in trusts not only provides tax advantages but also ensures that your wealth is distributed according to your wishes, reducing the potential for familial disputes.

To further fortify your estate plan, focus on assets that promise long-term growth. Consider these strategic investment avenues:

- Index funds for their low fees and broad market exposure.

- Dividend-paying stocks to generate passive income.

- Tax-advantaged retirement accounts for maximizing growth potential.

- Alternative investments such as private equity for diversification.

- Life insurance policies that can serve as both a safety net and an investment vehicle.

Utilizing Professional Guidance for Strategic Financial Decisions

In the intricate landscape of family wealth management, seeking the expertise of seasoned professionals can be a game-changer. Engaging with financial advisors who possess a deep understanding of market dynamics and investment strategies ensures that your decisions are not only informed but also strategically sound. Their insights can help mitigate risks and capitalize on opportunities that align with your family’s long-term financial goals.

Consider these pivotal advantages of professional guidance:

- Customized Portfolio Management: Experts tailor investment strategies to fit your family’s unique risk tolerance and financial objectives.

- Comprehensive Risk Assessment: They provide thorough analyses of potential risks, safeguarding your assets against market volatility.

- Access to Exclusive Opportunities: Professional advisors often have access to investment opportunities not readily available to individual investors.

- Tax Efficiency Strategies: Skilled advisors navigate complex tax landscapes to optimize your investment returns.

- Ongoing Monitoring and Adjustment: Regular reviews and adjustments ensure your investment strategy remains aligned with evolving market conditions and family needs.