In today’s rapidly evolving economic landscape, planning for your child’s college education has never been more critical. With tuition costs climbing at an unprecedented rate, parents face the daunting challenge of securing a financial future that ensures their children have access to quality higher education without the burden of overwhelming debt. This article delves into the most effective strategies for building a robust college savings plan, examining a range of options from 529 plans to custodial accounts, and beyond. By evaluating the benefits and drawbacks of each approach, we aim to equip parents with the knowledge and confidence needed to make informed decisions that align with their financial goals and aspirations for their child’s future. Join us as we navigate the complexities of educational savings, offering a comprehensive analysis to empower families to invest wisely in their child’s academic journey.

Exploring Diverse Savings Accounts for Educational Expenses

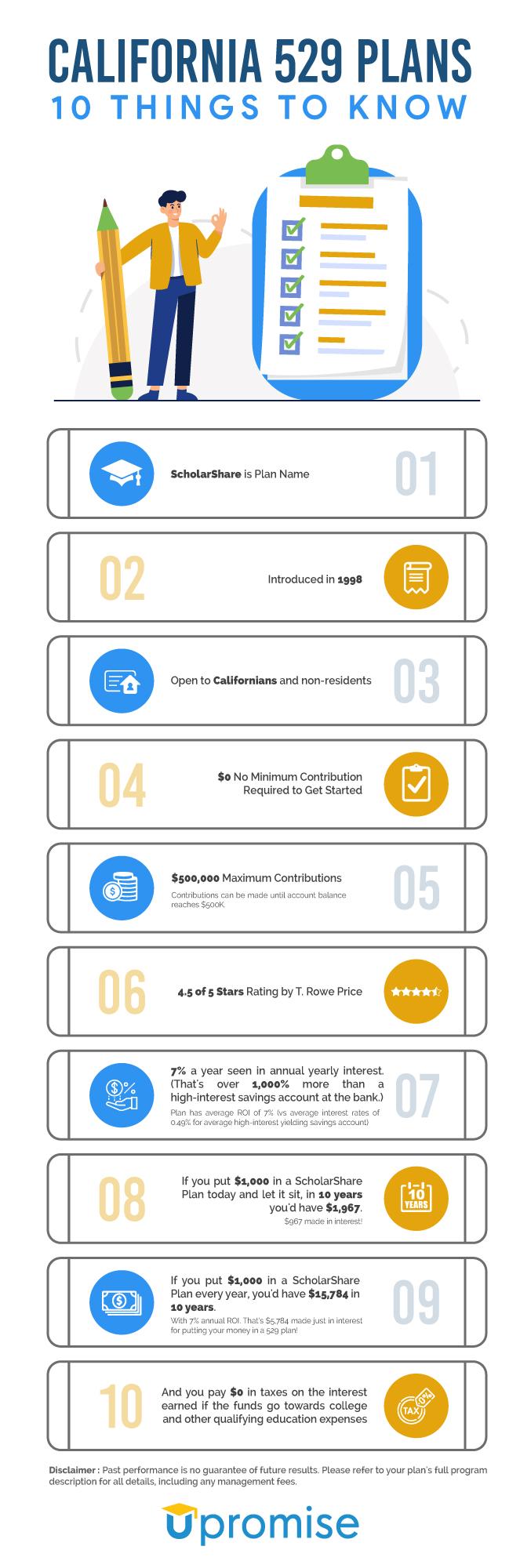

When considering savings accounts to fund your child’s college education, it’s essential to explore the varied options available, each with its own set of advantages and considerations. 529 Plans are a popular choice, offering tax-free growth and withdrawals for qualified educational expenses. These plans are state-sponsored and often provide flexibility to transfer funds between beneficiaries, should your child decide not to pursue higher education.

Another option to consider is the Coverdell Education Savings Account (ESA), which allows for tax-free growth and distribution, similar to 529 Plans, but with more flexibility in investment choices. However, contributions are capped annually, and there are income limitations for eligibility. For those looking for alternatives beyond these traditional options, consider the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts. These accounts offer the advantage of transferring funds for educational purposes without the limitations of educational savings plans, though they do not provide the same tax benefits.

- 529 Plans: Tax advantages, state-sponsored, beneficiary flexibility.

- Coverdell ESA: Flexible investments, tax benefits, income limitations.

- UGMA/UTMA Accounts: No educational use restrictions, lack of tax benefits.

Maximizing Tax Benefits Through College Savings Plans

When it comes to financing your child’s higher education, leveraging tax-advantaged savings plans can significantly enhance your investment returns. 529 plans are among the most popular options, offering both federal and state tax benefits. Contributions to these plans grow tax-free, and withdrawals are also tax-free when used for qualified educational expenses. Additionally, some states offer tax deductions or credits for contributions, amplifying the savings potential.

Besides 529 plans, consider Coverdell Education Savings Accounts (ESAs), which also allow tax-free growth and withdrawals for educational purposes. While the contribution limits are lower than those of 529 plans, ESAs offer more flexibility in investment choices. For families aiming to maximize their tax benefits, the combination of these plans can provide a robust strategy. Keep in mind the following advantages:

- Tax-Free Growth: Both plans offer tax-free growth on investments, maximizing returns over time.

- State Tax Benefits: Some states provide additional tax incentives for contributions to 529 plans.

- Flexible Use of Funds: Funds can be used for a wide range of educational expenses, including tuition, fees, and even some K-12 costs.

Strategic Investment Approaches for Long-Term Growth

When planning for your child’s future, adopting strategic investment approaches is crucial for ensuring long-term growth and financial security. Consider diversifying your portfolio to balance risk and reward effectively. Start by exploring 529 College Savings Plans, which offer tax advantages and flexibility. These plans allow you to invest in a range of options, from mutual funds to ETFs, tailored to meet your risk tolerance and investment goals. Additionally, Coverdell Education Savings Accounts (ESAs) can be an excellent choice for those seeking more control over investment selections, though contributions are limited.

Another vital strategy is to leverage Roth IRAs for college savings. While traditionally used for retirement, the flexibility of a Roth IRA allows for tax-free withdrawals on contributions, providing a dual benefit if your child doesn’t need the funds for education. Also, consider investing in individual stocks or bonds to potentially yield higher returns, though it’s essential to assess the associated risks carefully. Lastly, don’t overlook the power of regular contributions and compounding interest. Setting up automatic contributions can ensure consistent growth over time, maximizing the potential of your chosen investment vehicles.

Balancing Risk and Security in Education Fund Portfolios

When strategizing for your child’s educational future, it’s crucial to strike a delicate balance between risk and security in your investment portfolio. Opting for a mix of diversified assets can help achieve this equilibrium. Consider incorporating a blend of equities for growth potential and fixed-income securities for stability. Mutual funds and exchange-traded funds (ETFs) offer diversified exposure to both, potentially reducing the volatility that comes with stock investments while providing opportunities for returns higher than traditional savings accounts.

- Equities: While these come with higher risk, they have historically provided substantial returns over the long term, making them suitable for younger children whose college savings have time to grow.

- Bonds: Offering a safer investment, bonds can provide steady income and help cushion the portfolio against market downturns.

- 529 Plans: These tax-advantaged accounts are specifically designed for education savings, offering a range of investment options that can be adjusted as your child approaches college age.

By thoughtfully managing these components, you can build a resilient portfolio that navigates the fluctuations of the market while steadily advancing towards your financial goals.