In the complex realm of estate planning, the potential for legal disputes can loom large, threatening to unravel the very intentions behind your carefully crafted plans. As individuals seek to safeguard their legacies and ensure their wishes are honored, structuring an estate to preemptively address and mitigate conflicts becomes paramount. This article delves into the strategic frameworks and legal instruments that can fortify an estate against potential challenges, offering a comprehensive guide for individuals aiming to minimize familial discord and legal entanglements. With an analytical lens, we will explore the essential components of a robust estate plan, highlighting the proactive measures that can secure your assets and intentions against unforeseen legal disputes. Armed with this knowledge, you can approach estate planning with confidence, ensuring a smooth transition of your wealth and values to future generations.

Understanding the Legal Framework: Key Considerations for Estate Planning

When it comes to estate planning, navigating the legal landscape is crucial to safeguarding your assets and ensuring your wishes are respected. A well-structured estate plan not only provides clarity for your heirs but also minimizes the potential for legal disputes. Key considerations include:

- Clear Documentation: Ensure all documents, such as wills and trusts, are meticulously drafted and clearly articulate your intentions. Ambiguities can lead to misunderstandings and conflicts among beneficiaries.

- Regular Updates: Life changes such as marriage, divorce, or the birth of a child necessitate updates to your estate plan. Regular reviews ensure that your plan remains aligned with your current circumstances and wishes.

- Choice of Executor: Select a reliable and impartial executor to manage your estate. Their role is pivotal in executing your plan and mitigating potential disputes.

Incorporating these considerations can significantly reduce the likelihood of legal challenges and provide peace of mind that your estate will be handled according to your desires.

Crafting a Comprehensive Will: Essential Elements and Best Practices

Creating a will that stands up to scrutiny involves more than simply listing your beneficiaries. To minimize potential legal disputes, it’s crucial to include specific elements that clearly convey your intentions. Clarity is key: use precise language and ensure that each provision is unambiguous. Consider appointing a competent executor who understands your wishes and is capable of managing your estate effectively. Also, incorporate a residuary clause to account for any assets not specifically mentioned, which helps prevent intestacy issues.

- Detailed Asset Inventory: List all assets with specific descriptions, including account numbers or unique identifiers where applicable.

- Beneficiary Designations: Clearly name each beneficiary and their respective shares to avoid conflicts.

- Contingency Planning: Specify alternative beneficiaries or plans for unforeseen circumstances.

- Guardianship Provisions: If you have minor children, appoint a guardian to ensure their care is handled by someone you trust.

By incorporating these elements, you create a robust will that not only reflects your wishes but also minimizes the potential for familial strife and legal challenges. Regularly reviewing and updating your will can further ensure that it aligns with any changes in your circumstances or intentions.

Leveraging Trusts: A Strategic Approach to Mitigating Legal Risks

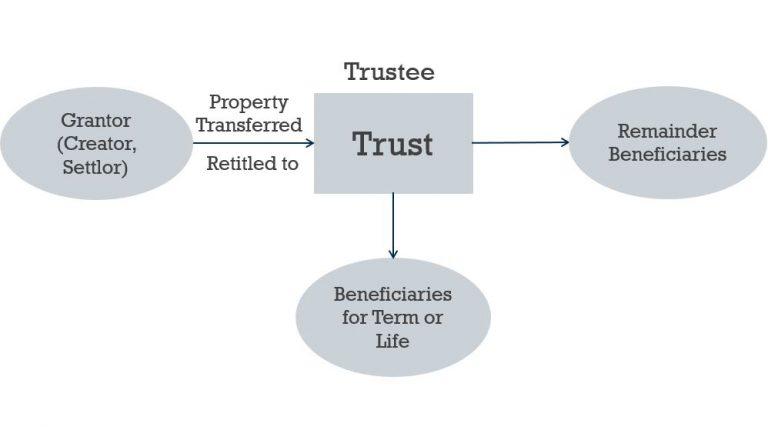

Utilizing trusts as part of your estate planning can be a powerful strategy to minimize potential legal conflicts. Trusts offer a degree of flexibility and control over asset distribution that traditional wills often lack. By placing assets into a trust, you create a legal entity that holds and manages these assets according to the terms you set. This not only ensures your wishes are carried out but also provides a shield against potential claims and disputes from beneficiaries or external parties.

Consider these key benefits of incorporating trusts into your estate plan:

- Privacy Protection: Unlike wills, which become public record after probate, trusts remain private, safeguarding sensitive information from public scrutiny.

- Probate Avoidance: Assets held in a trust typically bypass the probate process, reducing the time and expense involved in settling your estate.

- Control Over Distribution: Trusts allow for specific instructions on how and when beneficiaries receive their inheritance, helping to prevent mismanagement or premature access.

- Protection Against Legal Challenges: The structured nature of trusts can deter disputes and provide a clear legal framework that supports the settlor’s intentions.

By understanding and implementing these elements, you can significantly reduce the risk of legal disputes and ensure a smoother transition of assets to your beneficiaries.

Incorporating Advanced Directives: Ensuring Clarity and Reducing Conflicts

When structuring an estate, incorporating advanced directives is crucial for ensuring that your wishes are honored and reducing potential conflicts among heirs. Advanced directives, such as living wills and durable powers of attorney, serve as legal documents that outline your preferences for medical treatment and appoint trusted individuals to make decisions on your behalf. By clearly stating your intentions, you minimize ambiguities and the risk of disputes among family members.

To effectively implement advanced directives, consider the following steps:

- Consult with legal professionals: Engage with an attorney specializing in estate planning to draft documents that align with your specific needs and comply with state laws.

- Communicate openly: Discuss your directives with family members and appointed representatives to ensure they understand your decisions and the rationale behind them.

- Regularly update your directives: Life circumstances change, and your directives should reflect your current wishes. Review and amend them periodically to prevent outdated instructions from causing confusion.

By proactively managing these elements, you create a robust framework that not only protects your interests but also fosters a harmonious environment for those you leave behind.