In an era where financial stability and security are more crucial than ever, crafting a long-term legacy plan for your family’s future stands as a vital endeavor. This strategic approach not only ensures the preservation and growth of your assets but also aligns with your family’s values and aspirations for generations to come. As we delve into the intricacies of legacy planning, this article aims to provide a comprehensive guide, unraveling the complexities and shedding light on the essential steps needed to establish a robust framework. By employing a methodical and analytical lens, we will explore the tools and strategies necessary to navigate the multifaceted landscape of estate planning, wealth management, and family governance. With confidence and clarity, we will empower you to lay the groundwork for a legacy that withstands the test of time, securing a prosperous and harmonious future for your descendants.

Identifying Core Values and Vision for Your Familys Legacy

At the heart of a lasting family legacy is a clear understanding of your core values and vision. These elements serve as the guiding principles that shape your family’s identity and future aspirations. To begin, consider what values are most important to your family. Is it integrity, resilience, or perhaps compassion? These foundational beliefs should resonate with every family member and be reflected in daily actions and decisions.

Creating a shared vision involves thoughtful reflection and open dialogue. Engage your family in discussions to explore questions like: What do we want to be known for? What impact do we want to have on our community and future generations? Through these conversations, aim to establish a cohesive vision that aligns with your core values and sets a clear direction for the legacy you wish to build. A well-defined vision acts as a compass, guiding your family through challenges and opportunities alike.

- Reflect: Spend time identifying the values that truly matter to your family.

- Communicate: Foster open discussions to ensure everyone’s voice is heard.

- Align: Ensure that your vision is consistent with your core values.

Strategic Financial Planning for Multi-Generational Wealth

In crafting a legacy plan that spans generations, the cornerstone lies in a comprehensive approach to financial stewardship. This involves not only amassing wealth but also implementing strategies to sustain and grow it across various economic climates. Key elements include establishing a diversified portfolio that balances risk with potential growth, ensuring that assets are protected through adequate insurance, and setting up trusts to manage estate taxes effectively. It’s essential to involve family members in the planning process, fostering a shared understanding of financial goals and responsibilities.

Additionally, educating the younger generation about financial literacy is crucial for sustaining wealth over time. Consider setting up a family governance structure that outlines roles, responsibilities, and decision-making processes. Important aspects to address include:

- Creating a family mission statement that aligns with long-term financial goals.

- Implementing regular family meetings to discuss financial matters and review the legacy plan.

- Incorporating philanthropic efforts to instill values of giving and community responsibility.

By prioritizing these strategies, families can ensure that their wealth serves not only as a financial asset but also as a means to uphold their values and aspirations for future generations.

Legal Structures and Trusts to Protect Family Assets

Choosing the right legal structures and trusts is crucial for safeguarding family assets and ensuring their longevity. Family trusts, for instance, can provide a robust framework for asset protection, shielding wealth from creditors and legal disputes while facilitating seamless intergenerational transfers. These structures not only help in minimizing tax liabilities but also ensure that the wealth is distributed according to the family’s wishes. Establishing a trust can provide a level of control over how and when beneficiaries receive their inheritance, which is particularly useful in managing complex family dynamics.

- Revocable Trusts: Offer flexibility, allowing changes or termination during the grantor’s lifetime.

- Irrevocable Trusts: Provide strong asset protection, though they limit the grantor’s control once established.

- Limited Liability Companies (LLCs): Useful for protecting business assets, offering both liability protection and tax advantages.

Furthermore, limited partnerships can be employed to segregate control and ownership, protecting family members who may not be involved in the day-to-day operations of family businesses. By carefully selecting and structuring these legal entities, families can effectively preserve their wealth, ensuring it endures for future generations. Each option comes with its own set of advantages and limitations, making it essential to consult with legal and financial advisors to tailor a plan that aligns with your family’s unique needs and goals.

Cultivating a Legacy of Leadership and Philanthropy

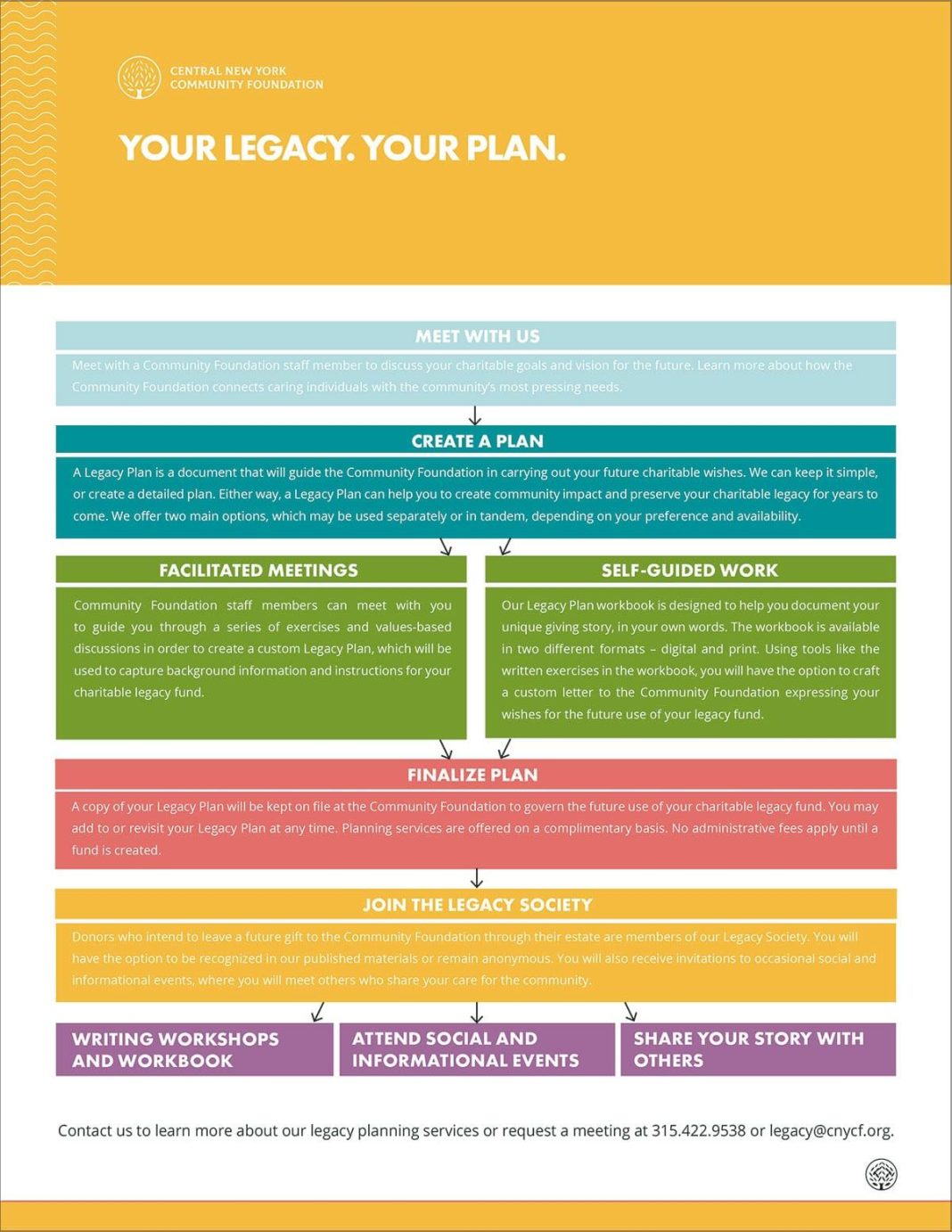

When envisioning a sustainable and impactful future for your family, integrating principles of leadership and philanthropy is essential. These elements not only enhance personal growth but also instill a sense of responsibility and community-mindedness. To lay the groundwork for such a legacy, consider these strategic approaches:

- Define Core Values: Establish a set of core values that resonate with your family’s vision. These values will serve as guiding principles, ensuring that each decision aligns with the desired legacy.

- Incorporate Education: Leadership is nurtured through knowledge. Encourage continuous learning and provide opportunities for family members to engage in leadership development programs.

- Foster Philanthropic Engagement: Create a family foundation or regularly participate in charitable activities. This not only builds a culture of giving but also strengthens community ties.

By focusing on these strategies, you cultivate an environment where leadership and philanthropy flourish, ensuring that your family’s legacy is both influential and enduring. The key lies in consistent reinforcement and active participation, paving the way for a future where each family member feels empowered to make meaningful contributions.