In today’s complex financial landscape, safeguarding your family’s wealth extends beyond prudent investing and effective budgeting; it necessitates a strategic approach to mitigating legal risks. As families accumulate assets, they inadvertently expose themselves to a myriad of legal challenges that can undermine their financial security. From unforeseen lawsuits and liability claims to estate disputes and regulatory changes, the potential threats are diverse and ever-evolving. This article delves into the critical measures that can be employed to shield your family’s wealth from these legal pitfalls. By analyzing key strategies such as asset protection trusts, comprehensive estate planning, and liability insurance, we aim to equip you with the knowledge and confidence to fortify your financial legacy against potential legal adversities.

Identifying Potential Legal Threats to Family Wealth

Family wealth is often vulnerable to various legal threats that can arise unexpectedly, and identifying these risks early is crucial for effective protection. Potential legal threats can stem from numerous sources, such as business disputes, where disagreements between partners or breaches of contract can lead to costly litigation. Another significant risk is estate planning errors; without a well-structured plan, families might face disputes over inheritance, leading to protracted legal battles. Marital breakdowns also pose a threat, as divorce settlements can dramatically impact family assets if not carefully managed.

Moreover, the rise of cybercrime has introduced new legal challenges, where families must be vigilant against fraud and identity theft, which can deplete financial resources. Tax liabilities present another area of concern; changes in tax laws or improper tax planning can result in unexpected liabilities, impacting the family’s financial stability. Lastly, regulatory compliance issues may arise, especially for families involved in businesses that operate under strict legal frameworks. By proactively addressing these potential threats, families can implement strategies to safeguard their wealth, ensuring its preservation for future generations.

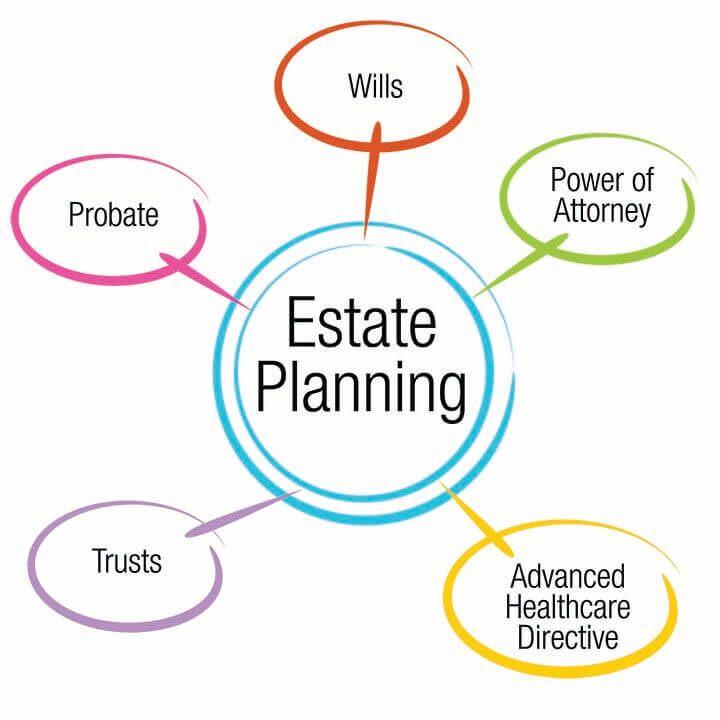

Strategic Estate Planning for Long-term Asset Protection

In navigating the complex landscape of asset protection, it is essential to establish a comprehensive approach that ensures the long-term security of your family’s wealth. A key component of this strategy involves leveraging legal structures that can shield assets from potential claims and litigation. Trusts and Limited Liability Companies (LLCs) serve as foundational tools in this regard. Trusts can segregate personal assets from business liabilities, while LLCs provide a layer of protection by separating personal and corporate responsibilities. Implementing these structures not only fortifies your estate but also optimizes tax efficiencies, ensuring that your wealth is preserved across generations.

Additionally, meticulous documentation and regular reviews of your estate plan are crucial. Consider integrating the following practices into your strategy:

- Regularly update wills and trusts to reflect any changes in family dynamics or financial circumstances.

- Establish clear lines of communication with beneficiaries to prevent disputes and misunderstandings.

- Consult with legal and financial experts to stay informed about changes in laws and regulations that could impact your estate.

- Diversify your asset portfolio to mitigate risks associated with market fluctuations.

By adopting these measures, you create a robust framework that not only defends your assets from legal challenges but also ensures a legacy of financial stability for your family.

Implementing Trusts and Legal Instruments to Safeguard Wealth

When it comes to protecting your family’s wealth, implementing legal instruments such as trusts can be an effective strategy. Trusts offer a robust framework for managing assets, providing both flexibility and control. They allow you to specify how and when your wealth is distributed, ensuring that it aligns with your long-term goals. Additionally, trusts can shield your assets from potential creditors and legal claims, offering a layer of protection that other financial tools may not provide.

There are several types of trusts to consider, each with its unique benefits and purposes. Some of the most commonly used include:

- Revocable Trusts: These allow you to retain control over your assets and can be altered or dissolved at your discretion.

- Irrevocable Trusts: Once established, these cannot be modified without the beneficiary’s consent, providing greater protection from estate taxes and creditors.

- Spendthrift Trusts: Designed to protect beneficiaries from poor financial decisions, these limit access to the trust’s principal.

- Charitable Trusts: Offering tax benefits, these are set up to benefit charitable organizations while serving your philanthropic goals.

By selecting the appropriate trust structure, you can effectively safeguard your family’s wealth, ensuring it is preserved for future generations.

Ensuring Compliance with Tax Laws to Prevent Financial Liabilities

One of the cornerstones of safeguarding your family’s financial future is adhering to tax regulations meticulously. The repercussions of non-compliance can be severe, ranging from hefty fines to criminal charges. To ensure you are on the right side of the law, consider implementing the following strategies:

- Stay Informed: Tax laws are subject to frequent changes. Regularly updating yourself on new tax codes and regulations can prevent accidental breaches.

- Consult Professionals: Engaging with tax advisors or accountants can offer valuable insights. These professionals can guide you through complex tax structures and help optimize your tax strategy.

- Maintain Accurate Records: Keeping detailed and organized records of all financial transactions is crucial. This not only simplifies the filing process but also provides evidence in case of audits.

- Use Technology: Leverage accounting software and apps that ensure accurate calculations and timely reminders for tax deadlines.

By prioritizing compliance, you mitigate potential legal risks and safeguard your family’s wealth from unnecessary financial liabilities.