In recent years, inflation has emerged as a formidable force, quietly eroding the purchasing power of families across the globe. As prices rise and the cost of living escalates, the financial well-being of households is increasingly under threat. This article delves into the multifaceted impact of inflation on family wealth, examining how it diminishes savings, alters spending habits, and challenges long-term financial planning. With a confident and analytical lens, we will explore strategies to counteract these effects, equipping families with the knowledge and tools necessary to preserve and grow their wealth amidst an ever-changing economic landscape. By understanding the mechanisms of inflation and implementing effective financial strategies, families can not only safeguard their economic future but also seize opportunities for growth in uncertain times.

Understanding Inflations Erosion of Purchasing Power

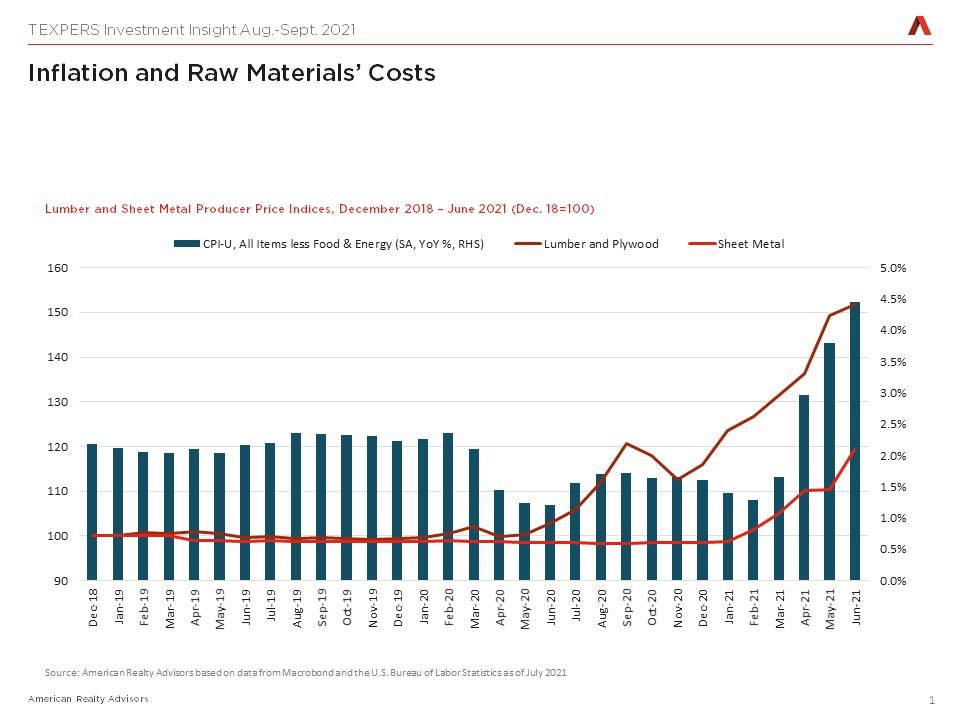

Inflation, the gradual increase in prices over time, subtly undermines the value of money, leading to a significant decline in purchasing power. Families may find that their savings don’t stretch as far as they once did, impacting their ability to afford goods and services. This erosion occurs because as prices rise, each unit of currency buys fewer goods and services than before, effectively reducing the wealth held in cash or low-interest savings accounts.

To combat this erosion, families can adopt several strategies:

- Invest in Assets: Consider diversifying investments into stocks, real estate, or commodities, which typically outpace inflation over the long term.

- Optimize Savings: Utilize high-yield savings accounts or inflation-protected securities to preserve the purchasing power of savings.

- Budget Adjustments: Regularly review and adjust family budgets to account for price increases, ensuring essential expenses are prioritized.

By understanding and anticipating inflation’s impact, families can strategically manage their finances to safeguard and potentially grow their wealth despite rising prices.

Analyzing the Long-Term Effects of Inflation on Family Assets

Over the years, inflation has been a persistent economic force that subtly erodes the purchasing power of money, thereby impacting family wealth. This gradual increase in prices means that families need more money to maintain their standard of living. As inflation creeps up, the value of cash savings and fixed income assets like bonds can diminish significantly, leading to a decline in real wealth. This erosion is particularly challenging for families who rely heavily on fixed incomes, as their financial resources may not stretch as far as they once did.

Families can mitigate these effects by adopting strategic financial practices. Here are a few approaches to consider:

- Invest in Inflation-Protected Securities: Consider diversifying your portfolio with assets that are designed to hedge against inflation, such as Treasury Inflation-Protected Securities (TIPS).

- Real Estate Investments: Property tends to appreciate over time, often outpacing inflation, making it a solid long-term investment.

- Equity Investments: Historically, stocks have provided returns that exceed inflation, helping to preserve and grow wealth over time.

- Regular Financial Review: Periodically reassessing your financial strategy can ensure that your assets are aligned with current economic conditions.

Strategies for Safeguarding Wealth in an Inflationary Economy

In the face of an inflationary economy, maintaining the purchasing power of family wealth requires astute financial strategies. One effective approach is to diversify investments across asset classes that typically outperform inflation. Consider allocating funds into real estate, which often appreciates in value over time, or commodities such as gold and silver, which historically act as hedges against inflation. Additionally, investing in inflation-protected securities, like Treasury Inflation-Protected Securities (TIPS), can safeguard the value of your assets as they adjust with inflation rates.

Another key strategy is to manage debt wisely. Refinancing existing loans at lower interest rates can mitigate the burden of rising costs, while opting for fixed-rate loans over variable ones can provide stability amidst economic volatility. Building a diverse portfolio that includes stocks from sectors known to thrive during inflationary periods, such as energy and consumer staples, can also help in preserving wealth. Lastly, maintaining a robust emergency fund in a high-yield savings account ensures liquidity without sacrificing returns, offering a buffer against unforeseen expenses. By implementing these strategies, families can effectively shield their wealth from the erosive effects of inflation.

Investing Wisely to Outpace Inflation and Build Family Wealth

Inflation is an insidious force that can erode the purchasing power of money over time, making it essential for families to adopt investment strategies that not only preserve but also grow their wealth. One effective approach is to diversify investment portfolios with a mix of assets that historically outperform inflation. Consider these key strategies:

- Stocks: Historically, equities have delivered returns that exceed inflation rates. Investing in a diversified portfolio of stocks, including dividend-paying companies, can provide both income and growth potential.

- Real Estate: Property investments can offer a hedge against inflation, as real estate values and rental income tend to rise with inflationary pressures.

- Commodities: Assets like gold, silver, and other commodities often appreciate in value during inflationary periods, providing a protective buffer.

- Inflation-Protected Securities: Instruments such as Treasury Inflation-Protected Securities (TIPS) are designed to protect against inflation by adjusting their principal value according to changes in the inflation rate.

By proactively managing investments and staying informed about economic trends, families can effectively safeguard their wealth against inflation and ensure financial stability for future generations. Embrace these strategies with confidence, knowing that a well-rounded investment plan is a robust defense against the erosion of wealth.