Retirement planning is often perceived as a daunting task, fraught with uncertainties and complex financial considerations. However, with the right approach and tools, it is possible to transform this potentially stressful process into a manageable and even empowering journey. In today’s rapidly evolving economic landscape, where financial stability and security are paramount, planning for your family’s retirement demands a strategic and analytical approach. This article delves into the essential steps and considerations necessary to craft a comprehensive retirement plan, ensuring that you can navigate this critical phase of life with confidence and clarity. By leveraging proven strategies and expert insights, you can lay a solid foundation for a future that promises not only financial security but also peace of mind for you and your loved ones.

Understanding Your Retirement Needs and Goals

When it comes to envisioning your future, identifying your retirement needs and aspirations is crucial for a stress-free transition. Begin by considering the lifestyle you wish to maintain. Are you dreaming of traveling the world, or do you envision a quiet life in the countryside? Each scenario requires a distinct financial strategy. Assess your current expenses and project them into the future, taking into account inflation and potential lifestyle changes. It’s also important to account for healthcare costs, which often rise with age.

- Financial Security: Determine the income sources you will rely on, such as pensions, savings, or investments.

- Health and Wellness: Consider the type of healthcare coverage you’ll need and any wellness activities you plan to pursue.

- Leisure and Hobbies: Factor in costs associated with hobbies or travel that enhance your quality of life.

- Family Support: Plan for any financial support you may wish to provide to family members.

By setting clear, realistic goals, you can craft a retirement plan that not only meets your financial needs but also aligns with your personal values and dreams. This strategic approach will empower you to navigate your family’s retirement with confidence and peace of mind.

Assessing Financial Resources and Creating a Budget

To ensure a stress-free retirement for your family, it’s crucial to take a detailed look at your current financial resources and devise a comprehensive budget. Start by evaluating all income streams, such as salaries, rental incomes, and dividends. This will provide a clear picture of what you have at your disposal. Next, examine your current expenses and categorize them into needs and wants. This differentiation helps identify areas where you can potentially save more for retirement. Don’t forget to factor in inflation and potential lifestyle changes that may affect future expenses.

Creating a budget is not just about cutting back; it’s about strategic allocation. Prioritize saving for retirement by setting aside a specific percentage of your income each month. Consider the following steps to enhance your financial planning:

- Maximize contributions to retirement accounts like 401(k)s or IRAs.

- Establish an emergency fund to cover unexpected expenses without dipping into retirement savings.

- Review insurance policies to ensure they align with your long-term goals.

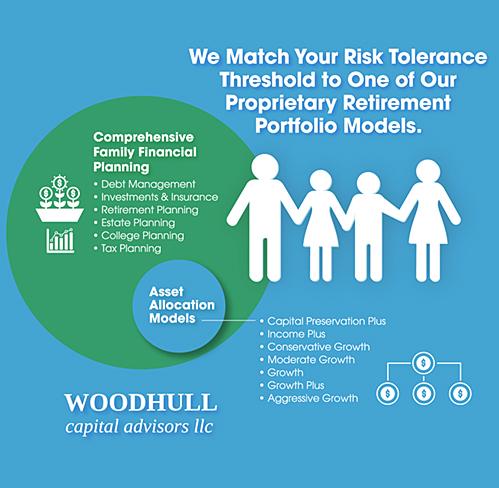

- Consult a financial advisor to tailor your strategy and keep you on track.

By taking these actions, you can build a robust financial foundation that supports your family’s retirement dreams without the added stress of financial uncertainty.

Strategizing Investments for Long-term Growth

When considering investment options for securing a comfortable retirement for your family, it’s essential to focus on strategies that foster long-term growth. The first step is to diversify your portfolio, which reduces risk and enhances potential returns over time. Key components to consider include:

- Stocks: Allocate a significant portion of your investments in stocks, as they historically offer higher returns compared to other asset classes.

- Bonds: Incorporate bonds for stability, which can provide steady income and act as a buffer against market volatility.

- Real Estate: Consider investing in real estate for both passive income and potential appreciation in property value.

- Mutual Funds/ETFs: Use these to gain exposure to a diversified set of assets, managed by professional fund managers.

Adopting a consistent investment approach is crucial. Regularly contributing to retirement accounts, such as IRAs or 401(k)s, takes advantage of compounding returns over the years. Periodic portfolio reviews and adjustments, in response to market trends and life changes, ensure alignment with your long-term goals. With a well-thought-out plan, you can navigate the complexities of investing and secure a financially stable future for your family.

Implementing Risk Management and Contingency Plans

In the realm of retirement planning, the significance of risk management and contingency plans cannot be overstated. Establishing a robust framework to mitigate financial risks ensures that unforeseen circumstances don’t derail your retirement aspirations. Key elements to consider include:

- Insurance Coverage: Evaluate life, health, and long-term care insurance options to protect against potential medical and personal emergencies.

- Diversification: Ensure your investment portfolio is diversified across various asset classes to spread risk and reduce potential losses.

- Emergency Fund: Maintain a liquid reserve fund to cover unexpected expenses without tapping into retirement savings prematurely.

Contingency planning acts as a safety net, offering peace of mind by preparing for potential disruptions. This involves setting clear financial priorities and establishing backup plans. Consider the following strategies:

- Scenario Analysis: Regularly assess different retirement scenarios, including best and worst-case outcomes, to adjust your strategies accordingly.

- Estate Planning: Ensure legal documents such as wills and trusts are up-to-date, reflecting current family dynamics and financial situations.

- Regular Reviews: Schedule periodic reviews of your retirement plan to stay aligned with changing goals, market conditions, and life events.